In

the beginning there was MIT Professor Jay W Forrester, born in 1918. He

graduated in Electrical Engineering in 1939, and while developing one of

the first digital computers invented random-access memory (RAM), which

is found in everyone's PC and laptop. He set up the Systems Dynamics

Group in 1956 from which emerged "Industrial Dynamics", which

was computer modelling of a business in development.

In

the beginning there was MIT Professor Jay W Forrester, born in 1918. He

graduated in Electrical Engineering in 1939, and while developing one of

the first digital computers invented random-access memory (RAM), which

is found in everyone's PC and laptop. He set up the Systems Dynamics

Group in 1956 from which emerged "Industrial Dynamics", which

was computer modelling of a business in development.

He followed this with "Urban Dynamics", which simulated the development and decay of a city. "World Dynamics" followed. Light was shed on the coming crisis in resources, when in 1972 the technique evolved into "The Limits to Growth", funded and published by the Club of Rome.

His RAM is universally utilised; but his systems legacy has been discarded as inconvenient. "Beyond the Limits" followed in 1992 and "The 30-years Update" as recently as 2004, but the conclusions and recommendations have been largely ignored and set aside, if not scorned.

The Limits to Growth

It is often assumed that the "Limits" forecast the end of petroleum in 1992, but what it actually stated was that if the then known global reserves were increased by a factor of 5 and exponential growth in demand continued, as it had up until then, the end of oil would be in 2022.

However, the real conclusions were more profound.

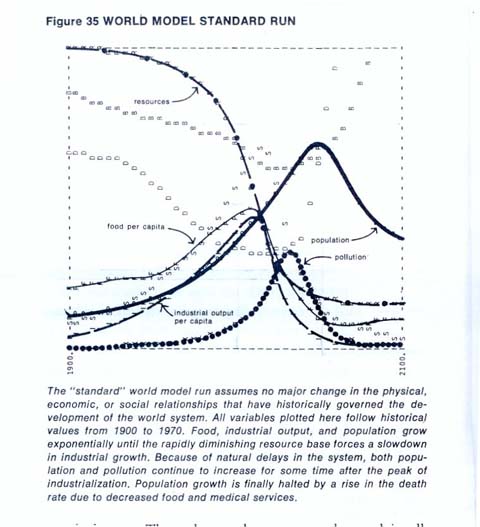

Figure 35 WORLD MODEL STANDARD RUN

On page 125 of the original "Limits" appears perhaps the most important extract:-

"The behaviour mode of the system shown in Figure 35 is clearly that of overshoot and collapse, which occurs because of non-renewable resource depletion. The industrial stock grows to a level that requires an enormous input of resources. In the very process of that growth it depletes a large fraction of the resource reserves available. As resource prices rise and mines are depleted, more and more capital must be used for obtaining resources, leaving less to be invested in future growth. Finally investment cannot keep up with depreciation and the industrial base collapses, taking with it the service and agricultural industries, which have become dependent on industrial inputs (such as fertilisers, pesticides, hospital laboratories, computers and especially energy for mechanisation)."

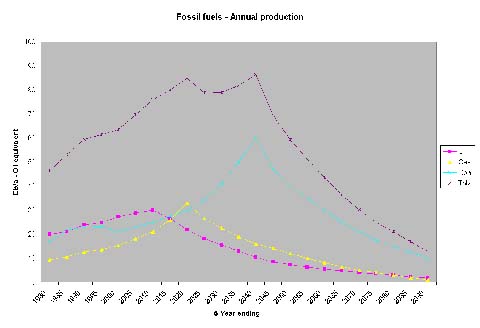

Peak oil, gas, uranium and coal

Advocates of a coming peak in oil production will find common ground in "The 30-year Update" of the "Limits". What determines the rate of production of oil, gas, uranium and coal is the efficiency of the capital employed, be it exploration capital, production capital or utilisation capital. (See “Sources and Sinks”, page 90) Once the rate of production exceeds the rate of discovery of new reserves, a peak in production is imminent. In the case of conventional oil reserves, production has exceeded discovery for a decade by a factor of 3 to 1 and a peak in regular oil production occurred in 2005, with the 'all-oil' peak following in 2010. (See ASPO monthly newsletters).

A recent off-shore oil discovery in the Gulf of Mexico, Jack 2, illustrates the point. Oil has been found 5 miles below sea level after an extremely expensive drilling operation using vast quantities of diesel, a derivative of the crude oil it intends to extract. More energy will be consumed in determining the size of the recoverable oil in the field and in its production, refining and distribution.

If the amount of oil products consumed over the life-cycle of the field exceeds that of the refined products from the oil extracted from it, then the operation will have simply reduced the energy inventory without augmenting it for use by consumers. Opponents of the peak oil philosophy have seized on the Jack 2 discovery to discount it, but in due course it may well end up endorsing it.

The major oil companies, though mostly denying an oil peak, have applied much of their capital to the acquisition of natural gas reserves, using a thermal oil equivalent of the gas to boost their overall "booked" reserves. Synthesising liquid fuels from gas is inefficient requiring commensurately more consumption, which means that a production peak in gas will advance rapidly, following that of oil in around 2020. (See ASPO newsletters).

Available uranium ore grades are in decline and a fall-off in mining production will limit the resurgence of nuclear power, but what of coal, which it is assumed will last for hundreds of years? Given that the problem is retaining mobility, the use of coal for the synthesis of liquid fuels, will naturally follow. However, coal liquefaction processes, used in wartime and to counter sanctions in South Africa, are even less efficient than the gas-to-liquids processes.

Reference to BP's Statistical Review of World Energy 2006 reveals proved coal reserves totalling 909 billion tonnes, which at the current rate of production of 5.8 billion tonnes per annum will presumably last 155 years. The coal is rated under two categories, 478 billion tonnes of 'anthracites and bituminous' and 430 billion tonnes of 'sub-bituminous and lignite'. Anyone visiting East Germany before 1990, will have smelt the sulphurous tang of the lignite (15-19 MJ/kg) "brown coal" briquettes, which kept the populace warm. Sub-bituminous coal (20-28 MJ/kg) is little better than lignite, containing 20% to 30% moisture by weight. Bituminous coal (27 MJ/kg) contains bitumen, while the most desired is anthracite (27-30 MJ/kg).

On a calorific value basis a tonne of anthracite and bituminous coal is equivalent to 0.67 tonnes oil equivalent or around 5 barrels oil equivalent (boe), whereas this drops to 0.33 tonnes or 2.5 boe for sub-bituminous and lignite. This means that the coal reserves equate to around 3,500 gigabarrels oil equivalent (Gboe), compared with the 1,200 Gb of oil reserves at the end of 2005. But a true comparison depends on the thermal efficiency of the coal liquefaction processes used to synthesise liquid fuels, which can be as low as 20%. China has licensed the South African Sasol process and as oil and gas supplies come into short supply and others will follow suit.

The other diminuting feature of coal use is the declared intention to use "clean coal" processes which will sequestrate carbon dioxide and compress it to push it underground in old mines and oil fields. Although its use in the latter may in some cases assist in the extraction of oil from decaying fields, the additional energy required for the separation and compression of the CO2 leads to a lower overall coal utilisation efficiency.

Taking into account the poor specification of the sub-bituminous and lignite coal and the inefficiencies of the adopted synthesis processes, a peak in coal production can be expected around 2040 to 2050. See the anticipated oil, gas and coal production plot below in Gboe.

Stern Review: The economics of climate change

The 2006 Stern Review examines the economic implications of climate change and of a transition to a low-carbon economy. It reckons that in 2006 the level of carbon dioxide concentration in the atmosphere was 430 ppm. (In 1972 the "Limits" provided a plot of atmospheric carbon dioxide with a forecast level in 2000 of 380 ppm, showing in this regard its accurate modelling technique). Assuming emissions remain at 2006 levels, Stern reckons that a level of 550 ppm would be reached in 2050, but that if exponential growth in the world's economies continues this level will arise sooner by 2035.

Under Stern's "business as usual" scenario the stock of greenhouse gases could more than treble by the end of the century, but this conclusion is based on continued exponential growth in fossil fuels consumption. If the analysis resulting in the oil-gas-coal production plot above is correct, it means that by the end of the century only a modicum of coal remains.

Moreover the "Limits" World Model Standard Run shows that by 2050 industrial output and resources are minimal and the corresponding emissions of carbon dioxide can be ignored. The Stern Report needs to be re-written to take into account the peak oil/gas/uranium/coal philosophy and "The Limits to Growth" modelling, which it has failed to incorporate.

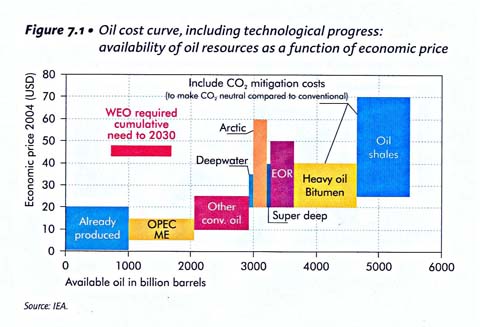

It has based its view of oil reserves on a chart from an International Energy Agency (IEA) report (Figure 7.2 in the Stern Report Part III), assuming vast unextractable non-conventional oil reserves.

The deep water, Arctic and super deep occurrences are unlikely to make more than a minor contribution because of the high costs of extraction. In Canada, tarsands production has stalled and the extraction of oil from shales is energy uneconomic. (See Alberta EUB st98 report and the RAND report). In any case, the depletion of the conventional oil reserves will have emptied the investment coffers and the oil majors' capital will have been expended on gas and its derivatives.

Stern considers whether "increasing scarcity will drive up the relative prices of fossil fuels sufficiently to choke off demand" (page 185), but dismisses this in view of the IEA assurances that proven reserves of gas and coal "are even more plentiful than oil" (World Economic Outlook 2004, Summary). Instead, it recommends that governments throttle economic growth by applying green taxes, using the revenue for amelioration of climate change.

Carbon trading

This consists of a system of tradable carbon credits. Assuming it is carbon free, which it is not, nuclear power would be granted carbon credits which it could sell to a carbon emitter, such as a coal-fired power station. There are now carbon trading companies so that the bartering would be indirect. The Energy Review 2006 concluded that nuclear power will only be economically viable if it can earn carbon credits worth more than £7/tonne CO2.

As the nuclear operational cycle is claimed to endure for 40 to 60 years, this means that purchasers of the carbon credits must also remain in business throughout the same period. However, as most of the fossil fuels will be gone before the operational cycles are over, there will be no significant purchasers able to take up the credits, albeit erroneously granted. The likely nuclear station builders, EdF and Suez-GdF, have insisted on guaranteed carbon credits for 100 years, which, in effect, amounts to a permanent subsidy.

The fact that the actual fission in the reactor is the only element of the nuclear fuel cycle that does not emit carbon dioxide has been conveniently ignored. Also some of the emissions will arise abroad in the countries where the uranium is mined, which in a global context should be taken into account. So carbon credits for nuclear generation would in any case be unjustified.

Pure charity

However, the nuclear lobby has come up with a cunning plan worthy of Baldrick. A charity called "Pure" has been formed into which funds can be paid as "guilt money" by carbon polluters. For instance, air travellers can pay a voluntary contribution of say £5 for a short haul and £15 for a long-haul flight into the fund. The tax-free charitable "Pure" funds can then be used to purchase carbon credits issued to a nuclear generator.

More realistically, commentators have asked what will be the destiny of the charges collected as a result of road pricing. Such could be redesignated as a carbon levy, paid by motorists and augmented by a tax on air travel. The monies collected thereby could then be used to subsidise nuclear power.

So the poor economics of nuclear power can be resolved by a mixture of charitable donations, a road pricing levy on motorists and airport taxes on air passengers.

Evasion

The most pressing problem facing mankind is the depletion of resources, not just fossil fuels, but minerals, land, forests and water. Rather than face up to the unpleasant reality so adequately portrayed by the "Limits" systems dynamics team as far back as 1972, governments have diverted our attention to the insoluble problem of global warming; insoluble because it needs a universal agreement to forsake economic growth, which no politician will embrace.

In order to maintain economic growth while reducing emissions, the only apparent large source of carbon free electrical energy, uneconomic nuclear power has been declared economic by the artefact of granting it carbon credits, which it does not deserve.

Survival?

Paradoxically, the ignored resource depletion may mean that climate change is ameliorated if the fossil fuels attenuate sufficiently to avoid the onset of James Lovelock's "tipping point", beyond which temperatures will rise inexorably. We will also be saved from the folly of a nuclear 'renaissance' by the decline in the ore grades of the uranium occurrences, which although universally present are too lean to provide an energy gain over the nuclear fuel cycle.

If the developed nations curtail their energy use to that which is genuinely renewable, they will survive. Regrettably, "The Limits to Growth" offers no respite from the undeveloped world's population die-off in mid-century, the resources of which have been lavishly expended by the developed world.

There could be just time to reconcile the "Limits" with reduced energy lifestyles; there is the beginnings of a re-localisation movement. Hopefully, James Lovelock is wrong and his "tipping point" has not yet occurred; fossil fuel depletion may be Gaia's way of saving us by forcing us to change our ways.

Links

The Limits to Growth , Meadows et al, Potomac Associates, 1972.

Beyond the Limits , Meadows et al, Earthscan Publications, 1992.

Limits to Growth: The 30-year Update , Meadows et al, Chelsea Green Publishing, 2004.