In

2002, the UK Department of Transport announced a consultation

on airport runway capacity, assuming that the usage of air transport

will double by 2015 and triple by 2030. . . The vocal opposition has

failed to emphasise that there will be insufficient jet fuel available

to allow the anticipated growth in air traffic to actually

transpire.

In

2002, the UK Department of Transport announced a consultation

on airport runway capacity, assuming that the usage of air transport

will double by 2015 and triple by 2030. . . The vocal opposition has

failed to emphasise that there will be insufficient jet fuel available

to allow the anticipated growth in air traffic to actually

transpire.

Air traffic expansion

In 2002, the UK Department of Transport announced a consultation on airport runway capacity, assuming that the usage of air transport will double by 2015 and triple by 2030. This assumes an exponential annual growth in passenger air traffic of 4.5% over the period. An expansion of air traffic in the UK would match a similar increase in international traffic. Domestic traffic in the UK and other countries would grow to feed rising international activity. The department concluded that airports should be expanded and additional runways built to match the anticipated demand.

Heathrow

and Stansted were selected as candidates for expansion, but Heathrow was

put on hold with concerns about rising levels of pollution, especially

from road traffic serving the airport. An application to build a second

parallel runway at Stansted is expected to be lodged in 2007 for

completion in 2015. In the meantime, attempts are underway to set aside

the environmental issues accompanying another runway at Heathrow

Heathrow

and Stansted were selected as candidates for expansion, but Heathrow was

put on hold with concerns about rising levels of pollution, especially

from road traffic serving the airport. An application to build a second

parallel runway at Stansted is expected to be lodged in 2007 for

completion in 2015. In the meantime, attempts are underway to set aside

the environmental issues accompanying another runway at Heathrow

National opposition to the overall expansion envisaged by the government has been mainly concerned with the increase in greenhouse gas emissions, currently unmitigated by a tax on aviation fuel. Local opposition has focussed on the destruction of an heritage landscape, which apart from the loss of agricultural land will destroy whole villages and societies. The vocal opposition has failed to emphasise that there will be insufficient jet fuel available to allow the anticipated growth in air traffic to actually transpire.

Peak oil and gas

The Association for the Study of Peak Oil and Gas (ASPO) has held five annual international conferences in which expert analyses of oil and gas production trends and the size of reserves have been presented. The business press has on the whole preferred to brush its findings aside;

| a hypothesis that characterises fossil fuel reserves as having a peak in production followed by a decline until little remains for economic extraction has no appeal to commentators wishing to promote economic growth. |

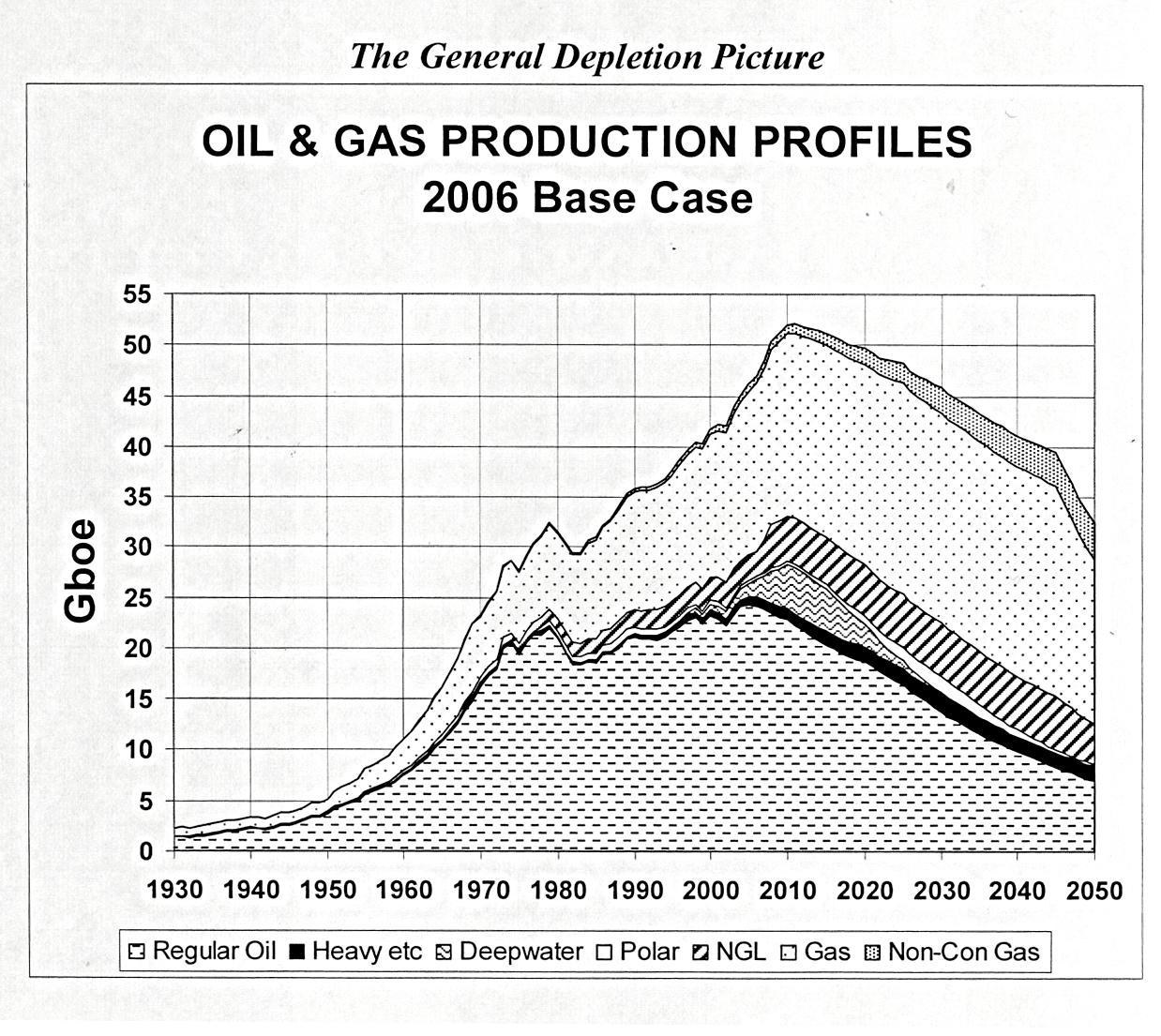

In its monthly newsletter, [1] ASPO publishes a plot of oil and gas production, which taking into account previous discoveries, forecasts the declining trends of both. Although the synthesis of jet fuel from natural gas or coal will offer some relief, there is no potential substitute for the bulk of the jet fuel currently obtained from crude oil. In any case, the remaining natural gas and coal will be required in substitution for the myriad of competing energy-consuming purposes currently reliant on oil.

The only other fuel likely to augment or substitute for oil-derived jet fuel is hydrogen, which has been tried in jet engines. [2] The problems are

- the poor efficiency in producing hydrogen from natural gas or by electrolysis,

- compounded by the energy needed to liquefy the gas for high pressure storage

- on suitably designed aircraft.

Moreover the transition would have to be universally applied as otherwise hydrogen-fuelled aircraft would be stranded at airports with no hydrogen infrastructure.

From the ASPO oil production plot, it is possible to estimate the amount of jet fuel remaining in the world's fuel tank and the number of air miles it can support. This will provide a reality check for the UK government's aviation expansion plans.

Jet fuel

Jet fuel is an oil refinery product, lighter than fuel oil, but heavier than petrol and is classed as a "middle distillate". Typically, North Sea crude oil will yield 37% petrol, 25% diesel, 20% kerosene (jet fuel/heating oil), 3% LPG and 12% fuel oil (heavy residue for power generation). A heavy crude oil will yield a much smaller proportion of petrol, diesel and kerosene; and the greater fuel oil residue will require further processing to transform it into lighter more useful fuels.

There is a reduction in the yield of jet fuel from 20% to 8-10% as North Sea crude oil production runs down and more Middle East crude has to be used. This means that the proportion of jet fuel to other refinery products is progressively reduced unless the refinery product profile is modified by installing additional equipment. More fuel is consumed internally, reducing the overall output while maintaining the yield of jet fuel, so a reduced refinery efficiency will apply from now as a greater proportion of Middle East crude oil is refined.

|

Civil aviation jet fuel requirement

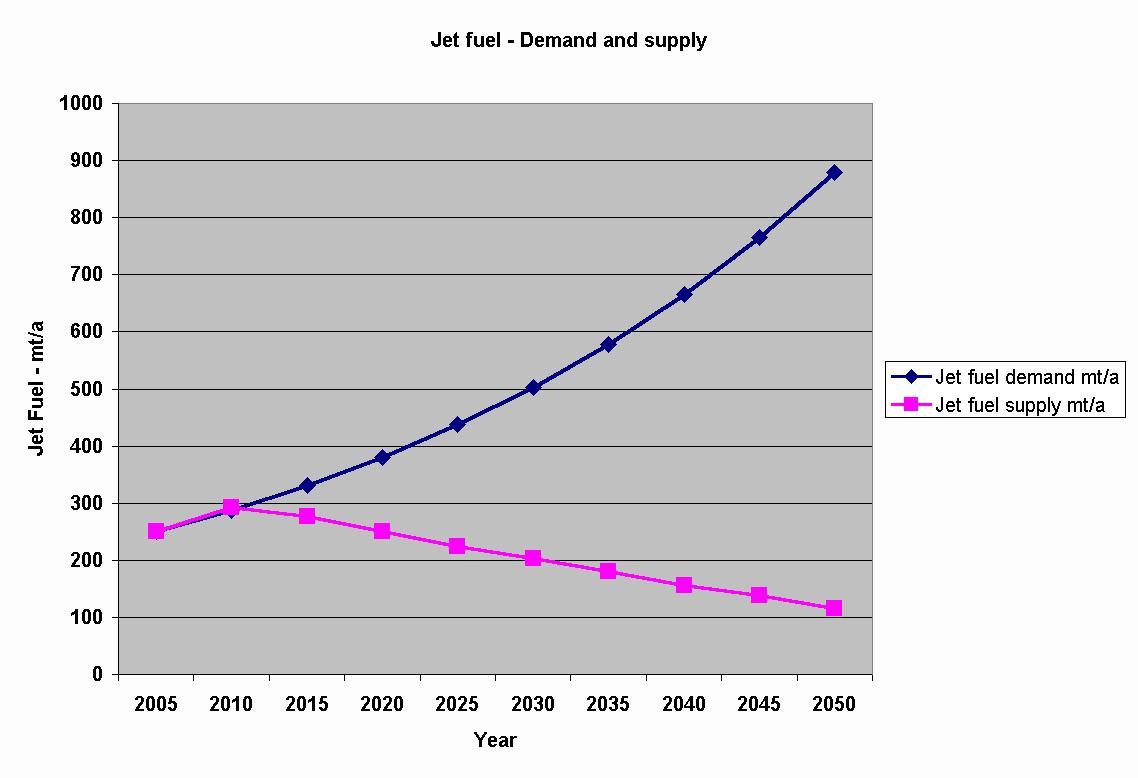

With the introduction of the Airbus A380 super-jetliner and other fuel efficient aircraft from Boeing, it is expected that the jet fuel requirement for a fleet gradually renewed will reduce by 2% per annum, so that a 4.5% increase per annum in passenger traffic and a 5.9% increase in freight traffic would result in a 2.5% and 3.9% increase in jet fuel consumption per annum respectively. Combining the two means an exponential increase in fuel demand of 2.85% per annum.

|

Assuming

- a jet fuel supply as 6.7% of "all-oils" production and

- taking into account the increasing fuel efficiency by the progressive deployment of new aircraft,

the jet fuel supply/demand and has been plotted on Figure 1 below.

Over the first 25 years with an exponential growth rate of 2.85%, jet fuel consumption rises from 250 million tonnes in 2005 to 500 million tonnes/annum, i.e., it has only doubled due to the postulated improvements in fuel efficiency, while the air traffic has trebled.

This equates to a consumption in the 11 years from 2005 to 2015 of 2930 million tonnes or 23 Gb of jet fuel and in the 25 years up to and including 2030 of 10375 million tonnes or 81 Gb of jet fuel. (A tonne of jet fuel has a volume of ca. 7.8 barrels)

Jet fuel availability

Returning to the ASPO plot:

- by 2015 "all-oils" oil production has fallen from a peak in 2010 of 33 Gb to 31 Gb.

- In 2015, the projected jet fuel requirement will be 2.6 Gb, which is an attainable 8.4% of global oil production.

- But by 2030, oil production will have fallen to 23.5 Gb, while the jet fuel requirement will have risen to 3.9 Gb rising to 17% of oil production.

Demand for other oil products will make the attainment of 17% of crude oil production as jet fuel impossible.

An exponential growth rate in passenger traffic of 4.5% and in freight traffic of 5.9% (in accordance with Airbus forecasts), even with the fuel efficiencies claimed, would require an amount of jet fuel impossible to procure.

Runways

In effect this means that over the 25 years leading up to 2030, only around 60% of the passenger and 45% of the freight markets’ expectations can be fulfilled, though the fuel deficit will be most evident towards the end of the period. Well before this, aircraft orders will be cancelled and the enhanced fuel efficiencies anticipated will not be realised as the proportion of old aircraft will rise, exacerbating the fuel shortages.

The UK Department of Transport and Airbus forecasts do not consider the fuel resource implications inherent in their projected expansion in air traffic. This unconsidered factor determines that the growth in traffic envisaged cannot be realised as jet fuel production will be unable to match demand. The higher the rate of depletion of limited oil reserves, the sooner the collapse of the air travel business.

The building of additional runways in order to satisfy a perceived rise in passenger air travel, raises expectations that cannot be fulfilled. The runways at Stansted and Heathrow, if they are ever built, will serve as parking lots for redundant aircraft.

The demise of the commercial aircraft industry will be signalled by the progressive grounding of the aircraft fleets, as a reduction in the supply of jet fuel will be the first indicator of the end of the oil era.

The aircraft manufacturers

Aircraft manufacturing is dominated by two giants, Boeing [5] and Airbus [6]. If it is clear to those most affected by oil depletion, are there signs of concern in their planning?

Boeing

took the first initiative by reducing its reliance on commercial

airplanes manufacture in favour of 'integrated defence systems'. In 1993

Boeing's commercial airplane manufacture comprised 80% of the turnover

and integrated defence systems 20%. In 2005 this changed to 41% and 59%

respectively. The diversification was achieved mainly by acquisition of

defence supply companies. National priorities will always ensure that

defence equipment is adequately fuelled, so the change of emphasis

hedges Boeing's business against the inevitable demise of the commercial

airplane sector.

Boeing

took the first initiative by reducing its reliance on commercial

airplanes manufacture in favour of 'integrated defence systems'. In 1993

Boeing's commercial airplane manufacture comprised 80% of the turnover

and integrated defence systems 20%. In 2005 this changed to 41% and 59%

respectively. The diversification was achieved mainly by acquisition of

defence supply companies. National priorities will always ensure that

defence equipment is adequately fuelled, so the change of emphasis

hedges Boeing's business against the inevitable demise of the commercial

airplane sector.

A similar policy has belatedly been adopted by the UK's BAe, which has recently sold its participating shares in Airbus to the holding company, the EADS Group, and it intends to concentrate on defence systems.

Governments are purchasers of last resort and will tend to support their suppliers "in the national interest" in times of economic difficulty. This does not mean that Boeing will not continue to compete with Airbus for the remnants of the commercial aircraft business, while Airbus maintains its demands for subsidies from host countries in order to secure jobs and to develop new aircraft.

Airbus myopia is demonstrated by the incorporation of an ever increasing proportion of carbon fibre composites in its component designs, even including the wings in its deployments. The fibres and the resins comprising the composites are essentially petrochemicals, so although they may assist in improving fuel efficiency, in the first instance there will be an increased use of oil.

UK air transport policy

Apart from the planned airport and runway expansions, the need to cater for the control of three times the current air traffic means that new flightpaths and "stacking" areas over Britain are planned. Even though there will be more traffic, the implications for climate change are mellowed by the claims for better fuel efficiency. Even if the predicted improvements in fuel efficiency mature, the triple increase in traffic will produce double the current emissions.

Fortunately the climate and the impact on neighbourhoods will eventually be relieved by the catastrophic demise of the industry, but the effect on local economies, temporarily boosted by the growth expectations, will be equally catastrophic.

Peak oil considerations

The concept of peak oil, or for that matter peak of anything, has failed to enter the mindset of government and industry. Papers delivered to five international ASPO conferences have failed to find a resonance in the media, industry journals or in ministries. Carbon trading is based on providing credits to low emitters procured by levies on high emitters. There is a failure to understand that as fossil fuels production attenuates, so will the combustion of the same and the amount of carbon emissions which can be taxed.

Conventional electricity generators, for instance, will be faced with higher fuel prices and demands for levies to be paid to their competitors, while finding it difficult to obtain fuel supplies. As the production of fossil fuels declines so will the ability to provide the credits that renewable sources earn and nuclear generators will erroneously claim that they deserve.

Peaks in gas and coal production will follow in 2020 and 2040-50 respectively, so that the first impact on public perception of the coming crisis will be the rapid decline in air and road transport, which in the case of air relies totally on oil and virtually so in the case of road transport.

It is to be regretted that it appears impossible for politicians, businessmen and economists to grasp the consequences of fossil fuel depletion. The "peak oilers" have to try harder.

[1] The most recent chart appears in a pdf file each month. The most recent can be found at

http://www.peakoil.ie/newsletter/en/pdf/newsletter75_200703.pdf

ASPO http://www.aspo-ireland.org

[2]

Cryoplane:

http://

www.haw-hamburg.de/pers/Scholz/dglr/hh/text_2001_12_06_Cryoplane.pdf

[3]

BP

Statistical Reviews

[4]

Airbus

Global Market Forecast 2001-2020

[5]

Boeing

annual reports

Note: "New plan revealed for flight-path Britain" can be found at the following link .