In

comparison with the amount of coal burned for a given electrical

generation, the nuclear proponents argue that the amount of uranium

required for the same output from a nuclear power station is tiny. This

leads to misleading statements intended to reassure the consumer that

nuclear power is "home grown" or "indigenous". In

comparison with insecure supplies of oil and gas from politically

unstable regions, it is claimed that it offers security of supply,

because such a small quantity of fuel can be readily procured and

stocked.

In

comparison with the amount of coal burned for a given electrical

generation, the nuclear proponents argue that the amount of uranium

required for the same output from a nuclear power station is tiny. This

leads to misleading statements intended to reassure the consumer that

nuclear power is "home grown" or "indigenous". In

comparison with insecure supplies of oil and gas from politically

unstable regions, it is claimed that it offers security of supply,

because such a small quantity of fuel can be readily procured and

stocked.

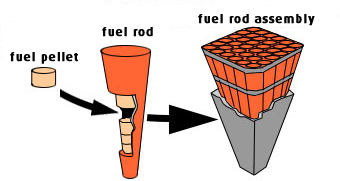

Natural uranium contains only 0.7% of the fissionable isotope U-235 and has to be enriched to around 3.6% to 4.5% for use in a modern reactor. This is a complex process involving the conversion of uranium, a heavy metal, into a gas (uranium hexafluoride) in which form the fissionable component can be increased by centrifuging or by diffusion. The gas is then re-converted into a solid oxide from which the nuclear fuel is manufactured. The enrichment process produces "tails" with a lowered U–235 content of 0.2% to 0.3% from the original 0.7%. The tails remain as a gas and are stored in cylinders, awaiting disposal or re-processing.

Starting with 207 tonnes of natural uranium the process produces 30 tonnes of uranium dioxide (containing 25 tonnes of uranium of both kinds) from which sufficient fuel is manufactured to run a one GW (a gigawatt = thousand megawatts or a million kilowatts) nuclear power station for a year. The UK uranium requirement for 2007 amounts to 2158 tonnes of natural uranium equivalent, which at the current price of uranium of US $338/kg (US $130/lb U3O8) is valued at US $730 million, though probably acquired for less under current supply contracts. Thus 2,000 tonnes of natural uranium fuels just over 9 GW of electricity generation or 79 TWh (terawatthours).

Uranium

is obtained from mines in a small number of countries, the principle

ones being Canada, Australia, Kazakhstan, Niger, Russia and Namibia. To

obtain 207 tonnes of natural uranium at the current world average

uranium ore grade of 0.15% means the mining of 880,000 tonnes of rock

and ore, which after enrichment produces the 25 tonnes needed in the

fuel. But as ore grades decline and recourse is made to low ore grades

of 0.045%, more than 3 million tonnes of rock and ore has to be mined

for the same 207 tonnes of natural uranium. In addition 500,000 tonnes

of mill tailings arise for disposal. The remaining deposits in Australia

are characterised by these low ore grades and yet it claims to hold the

world's greatest reserves.

Uranium

is obtained from mines in a small number of countries, the principle

ones being Canada, Australia, Kazakhstan, Niger, Russia and Namibia. To

obtain 207 tonnes of natural uranium at the current world average

uranium ore grade of 0.15% means the mining of 880,000 tonnes of rock

and ore, which after enrichment produces the 25 tonnes needed in the

fuel. But as ore grades decline and recourse is made to low ore grades

of 0.045%, more than 3 million tonnes of rock and ore has to be mined

for the same 207 tonnes of natural uranium. In addition 500,000 tonnes

of mill tailings arise for disposal. The remaining deposits in Australia

are characterised by these low ore grades and yet it claims to hold the

world's greatest reserves.

In comparison, a 1 GW coal-fired station consumes 2.87 million tonnes of coal per annum, which together with the removal of its overburden of say ½ million tonnes would mean the removal of a similar amount of material to that shifted and milled for an equivalent nuclear power station reliant on the lower ore grades. Apart from some sorting and washing, the coal extracted is used more or less as it is, but uranium ore has to be milled and chemically treated to produce triuranium octoxide (U3O8) known as "yellow cake", although it is green, in which form it is drummed off for export.

So a little uranium comes from a lot of stuff.

How much is the lot of the "little"?

Global natural uranium consumption in 2006 amounted to around an equivalent 65,000 tonnes, of which just under 40,000 tonnes of primary production came from mines. The missing 25,000 tonnes came from diluted ex-weapons highly-enriched uranium (HEU) from Russia, from inventories, from re-worked mine tailings and from a small amount of mixed-oxide fuel (MOX) made from recovered plutonium and depleted uranium.

Under the agreement around 30 tonnes of HEU is processed annually in Russia to produce the equivalent of around half of the US natural uranium demand of 20,000 tonnes.

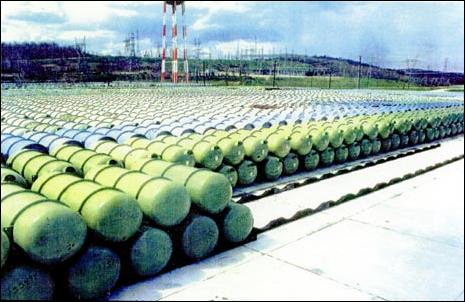

Under a US-Russian HEU purchase agreement, 500 tonnes of HEU from over 30,000 dismantled Russian nuclear weapons is being blended with low enriched uranium (LEU) by 2013. [1] Under the agreement, around 30 tonnes of HEU is processed annually in Russia to produce the equivalent of around half of the US natural uranium demand of 20,000 tonnes. It is necessary to understand "equivalent" because the fuel is supplied to the US as uranium hexafluoride gas (UF6) in cylinders at the correct level of enrichment (i.e. 4% - 4.5% U-235) in an amount which would arise from a feed of 10,000 tonnes of natural uranium to a normal nuclear fuel manufacturing process.

The Russians enrich UF6 tails (of 0.2% to 0.3% U-235 content) from their conventional enrichment processes (up to 1.5% U-235 content) for blending with the HEU (of 90% U-235 content) (which has first been extracted from dismantled weapons) and converted to UF6 gas so that the two streams of gas can be mixed.

This is a very good deal for the US as it means that half of its enrichment needs are provided in Russia, which is left with the disposal problem of the enrichment tails. As Russian natural uranium production is in deficit (3,400 tonnes cf. 3800 tonnes demand) and there are plans to build more nuclear stations, it is unlikely that the agreement will be continued after 2013.

A new enrichment plant is under construction in the US, but this will require the procurement of an additional 10,000 tonnes of natural uranium to replace the Russian HEU/LEU blended supplies, as well as providing for the enrichment of the other 10,000 tonnes of the 20,000 tonnes the US uses for its nuclear generation.

The other 15,000 tonnes per annum from the so-called secondary supplies comprising inventories and re-worked tailings is also expected to end with the ex-weapons material by 2013, with the exception of a little MOX production in France and Japan.

What happens when the secondary supplies are gone?

Meanwhile primary mining production fell 5% in 2006 over that in 2005. The biggest producers, Canada and Australia saw falls of 15% and 20%, with only Kazakhstan showing an increase. [2]

It

is difficult to predict just what the demand for natural uranium will be

after 2013, because some reactors under construction will require core

charges, but many will be closed due to aging problems or to policy as

in Germany. Some 40% additional capacity is planned, but some 20% will

close in the meantime. If a 20% rise to 78,000 tonnes per annum is

assumed, this means that an additional 38,000 tonnes of primary supplies

is required to cover the loss of the secondary supplies. But if, in the

meantime, the decline of 5% per annum in the existing mines' production

continues, then an additional 10,000 tonnes is required.

It

is difficult to predict just what the demand for natural uranium will be

after 2013, because some reactors under construction will require core

charges, but many will be closed due to aging problems or to policy as

in Germany. Some 40% additional capacity is planned, but some 20% will

close in the meantime. If a 20% rise to 78,000 tonnes per annum is

assumed, this means that an additional 38,000 tonnes of primary supplies

is required to cover the loss of the secondary supplies. But if, in the

meantime, the decline of 5% per annum in the existing mines' production

continues, then an additional 10,000 tonnes is required.

There are only two mines of adequate size likely to fill part of the gap in the available time scale, Cigar Lake in Canada in 2011 if it overcomes its flooding problems and Olympic Dam in Australia in 2014 if it passes its current feasibility study in 2009. [3] The anticipated production is 7,000 tonnes and 15,000 tonnes per annum respectively, but together they have no chance of filling a gap of between 25,000 tonnes to 48,000 tonnes, depending on the prevailing circumstances.

Both projects are characterised with serious deficiencies. Cigar Lake needs four years of refrigeration to contain the water in the sandstone above the workings, consuming 10 gigawatthours of electricity meantime before mining can begin, while Olympic Dam as an open pit is initiated by four years of excavation of 3 cubic kilometres of rock before the first kilogram of uranium is reached requiring 5 to 6 million tonnes of imported diesel.

Although Cigar Lake produces a lot of water from the flooding it is contaminated, but could presumably supply its own process water. In contrast, the Olympic Dam copper and uranium processing requires water, but it is situated in an area subject to severe drought and will require the building of a desalination plant.

So a "little" uranium needs a lot of diesel, electricity and water or refrigeration to cope with too much water.

Can a little be done with a lot of enrichment "tails"?

The

centrifuging process of enrichment is essentially a mechanical process,

with thousands of centrifuges spinning at a high speed. The molecular

weights of U-235 and U-238 are so close that it needs many small

incremental stages to achieve a high content of the fissionable

component. Not all of the U-235 can be removed from the uranium

hexafluoride gas and the amount left in the tails is a indication of the

efficiency of the enrichment process. The mechanical effort needed is

measured in "separative work units" (SWU's). If more SWU's are

employed it is possible to decrease the loss of U-235 in the tails,

making more available for fuel, in which case the tails contain perhaps

0.2% U-235 instead of 0.3% U-235.

The

centrifuging process of enrichment is essentially a mechanical process,

with thousands of centrifuges spinning at a high speed. The molecular

weights of U-235 and U-238 are so close that it needs many small

incremental stages to achieve a high content of the fissionable

component. Not all of the U-235 can be removed from the uranium

hexafluoride gas and the amount left in the tails is a indication of the

efficiency of the enrichment process. The mechanical effort needed is

measured in "separative work units" (SWU's). If more SWU's are

employed it is possible to decrease the loss of U-235 in the tails,

making more available for fuel, in which case the tails contain perhaps

0.2% U-235 instead of 0.3% U-235.

As uranium becomes less available, proportionally more fuel can be produced by employing more enrichment facilities. There are limits as to how much can be economically gained, but the U-235 content in the "tails" would be reduced, producing more in the "heads". '[4] To make use of the increasing inventory of enrichment tails, a massive investment in gas centrifuges would need to be made. For example in the UK around 25,000 tonnes of uranium resides in enrichment tails. To recover enough of the U-235 content to produce 2,000 tonnes of fuel by reducing the tails content from 0.3% to 0.1% would require 23 million SWU's, compared with around 1.2 million SWU's currently employed to fuel the existing fleet of reactors.

Can a little be done with the accumulated spent fuel?

Also in the UK resides around 30,000 tonnes of uranium in spent fuel, which also contains plutonium. After a period of some years in spent fuel ponds, the fuel elements can be then cut up and dissolved in acid, allowing the chemical separation of the uranium and plutonium. The plutonium can be mixed with uranium to produce a mixed oxide fuel (MOX), but the uranium would have to be converted to hexafluoride gas for re-enrichment by centrifuging, which would require around 20 million SWU's.

MOX is very expensive to produce and provides only a few percentage of the world's nuclear fuel. Further investment in enrichment is more likely to be used in squeezing a little more fuel out of declining supplies of natural uranium from mines.

What does this mean for the nuclear "renaissance"?

The industry deals with this embarrassing scenario by pretending that there is no uranium supply problem as there is ample residing in the earth's crust and that the rapidly rising prices that has stimulated exploration will make its extraction economic. Moreover, it argues that nuclear electricity is not as sensitive to its fuel price as other forms of generation relying on fossil fuels. See the analysis of the flawed IAEA "Red book" by the Energy Watch Group.[5]

The flaw in this argument is that unlike highly valued gold which is mined from decreasing ore grades at great expense, uranium can only be valued as a source of fuel now that the world has sufficient nuclear weapons to end human existence. This means that to mine and mill the decreasingly low grade ores requires an increasing amount of energy inversely proportional to the decrease, so that the energy input eventually exceeds that gained from the overall nuclear fuel cycle.

The exact "cross-over" or "economic cut-off" point at which an ore grade is deemed to be of no use as a net energy source is subject to disputation as even its very existence as a concept sounds the death knell of the "renaissance". In practice, it has been defined by the Australian mining industry as around an ore grade of 0.1% unless there are co-products such as copper, gold, silver or platinum which provide additional revenue. [6] As the average uranium ore grade in Australia is reckoned to be 0.045%, it means that claims of having the world's largest uranium deposits are bogus — unless the prospective mines offer remunerative co-products they will not be opened. Even so this is no panacea: BHP Billiton is engaged in a four year feasibility study as a precursor to sanctioning the expansion of its Olympic Dam mine as an open pit, where copper, gold and silver will augment its uranium production. [7] The pre-excavation of 3 cubic kilometres of rock may take too much imported diesel to allow it to proceed and the processing will need desalinated water, most likely requisitioned to stem a local drought. [8]

The fact that governments around the world appear to embrace the nuclear "renaissance" is a triumph of the public relations industry, which has overcome safety concerns and a poor economic record to allow nuclear power even to be considered. It has offered economic salvation as oil, gas and coal pass (or soon will pass) their production peaks and has argued erroneously that it can offer a part solution to global warming.

However, soaring prices for uranium supplied as "yellow cake" signal the end of the nuclear power era and the "renaissance" will stall when a lack of fuel causes the premature closure of aging reactors.