Oil

and Gas Net Exports

BP

Statistical Review 2008

BP has just published its annual Statistical Review which provides a

comprehensive review of statistics encompassing oil, gas and coal reserves,

production and consumption together with many other aspects of global energy

vital facts and figures. It contains historical data up until 2007, allowing

trends to be viewed.

It does have certain caveats as to the source of the data and indeed the

size of proven reserves is subject to much controversy as in spite of continuous

production some national reserves fail to reduce in size without parallel

statements of newly confirmed augmentations.

However, the figures for national production and domestic consumption of

oil and gas are for the purpose of this analysis deemed to be accurate. In any

case it is the proven reserves that are subject to dispute, while the point of a

production peak in a field is perhaps a better indication of the size of the

reserve, as it represents the half-empty point. The cumulative production before

the peak is reached can therefore allow the remaining production to be assessed.

There is another factor, which is that some of the major oil and gas

producers consume more than they produce and are thus net importers. Others

while declaring their production, fail to moderate their claims with that of

their consumption. An assessment of the net exports of these selected countries

is the subject of this article.

Main

producers

Of the top 18 main oil producer countries, 4 are net importers, while

another four are net exporters, but for the latter there is no consumption data

for them in the Statistical Review. The four net importers are the US, China,

Brasil and the UK. The other four exporters with no consumption data are

Nigeria, Iraq, Libya and Angola. The net exports of the 10 oil producing

countries with recorded levels of consumption will be tabulated. Five of these

10 major oil producers are also among the top 12 gas producers.

Of the top 15 gas producer countries, Saudi Arabia uses all its gas

internally, while the US and the UK are net importers, leaving 12 countries for

which the net exports will be reckoned.

Saudi

crude oil production and consumption

From figures in the BP Statistical Review the following table of

production, domestic consumption and net exported crude oil has been compiled.

|

1000

Barrels/day |

2003 |

2004 |

2005 |

2006 |

2007 |

|

Production |

10164 |

10638 |

11114 |

10853 |

10413 |

|

Consumption |

1684 |

1805 |

1891 |

2005 |

2154 |

|

Net export |

8480 |

8833 |

9223 |

8848 |

8259 |

The chart below has then been drawn from them.

From this it can be seen that Saudi oil production and net exports peaked

in 2005, while domestic production steadily increased. In fact, net exports

reduced by 10.5% in the two year period 2005-2007, of which a reduction of 6.7%

occurred in 2007.

Net exports in 2005 were 9.223 million barrels per day, 8.848 million

barrels per day in 2006 reducing to 8.259 million barrels per day in 2007.

Russian

Gas

From figures in the BP Statistical Review the following table of natural

gas production, domestic consumption and net exported crude oil has been

compiled.

|

bcm/year |

2003 |

2004 |

2005 |

2006 |

2007 |

|

Production |

578.6 |

591.0 |

598.0 |

612.1 |

607.4 |

|

Consumption |

392.9 |

401.9 |

405.1 |

432.1 |

438.8 |

|

Net exports |

185.7 |

189.1 |

192.9 |

180.0 |

168.6 |

The chart below has then been drawn from them.

From this it can be seen that Russian gas production peaked in 2006 and

net exports peaked in 2005, while after 2005 domestic production rapidly

increased. In fact, net exports reduced by 12.6% in the two year period

2005-2007, reducing by 6.3% in 2007.

Net exports in 2005 were 192.9 bcm, 180.0 bcm in 2006 reducing to 168.6

in 2007, comprising by then only 28% of production, whereas in 2005 exports

comprised 32% of production.

Trend

extrapolation

If the two lowering trends remain unmodified, extrapolation shows Saudi

net oil exports falling to zero by 2025, while Russian gas will cease to be

exported in 2020. For this catastrophe to be avoided new fields have to be

opened, domestic demand has to be restrained, or both. Population is rising in

Saudi Arabia and the Russian economy grows, so demand restriction is unlikely.

Principle

net oil exporters

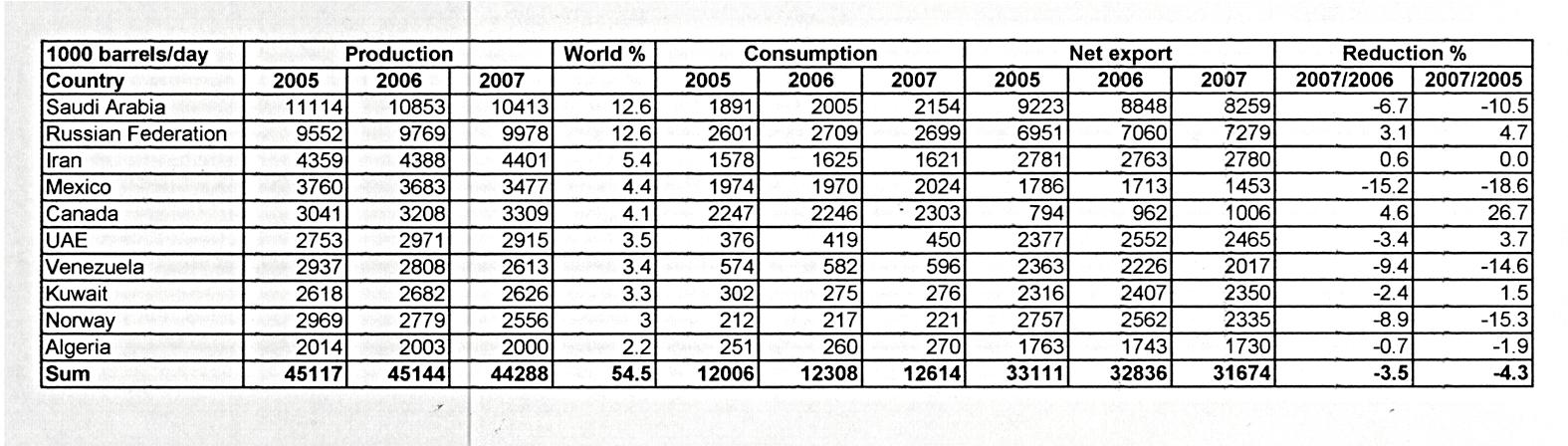

The net exports of the 10 oil producing countries with recorded levels of

consumption have been tabulated as below as below.

It can be seen from the row of sums of the 10 net exporters that

production fell by 1.9% while the aggregate internal consumption rose by 2.5%

yielding an overall decrease in net exports of -3.5%, which when paralleled with

rising

demand readily explains the recent rapidly increasing oil price.

Principle

net gas exporters

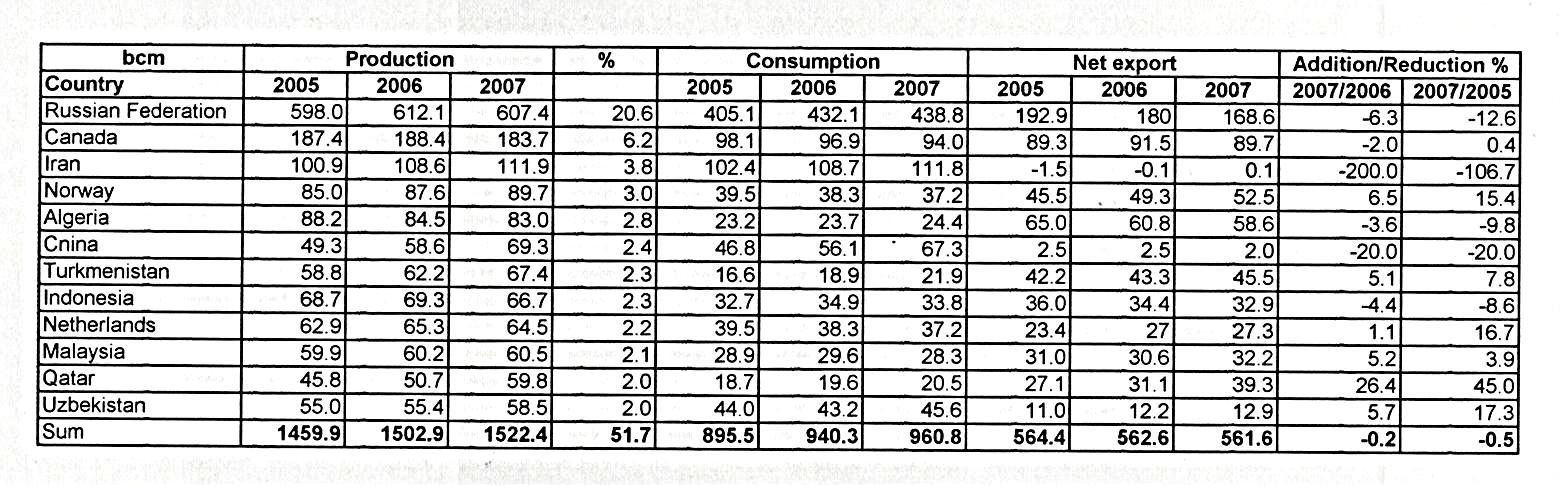

The net exporters of the 12 net gas exporters with recorded levels of consumption have been tabulated as below.

The situation is somewhat different in the case of gas net exports as the

overall production has risen slightly (1.3%), the consumption has risen

moderately (2.2%), so that only a reduction of 0.2% in net exports is shown.

However, the severe drop in the Russian net exports shows the need to balance

European pipeline supplies with LNG from countries such as Qatar.

Comments

It is too early to be sure that Saudi Arabian oil passed a production

peak in 2005 and that Russian gas

passed its production peak in 2006, but the rising domestic consumption in both

the major players in oil and gas respectively indicates that supply problems

will continue.

The UK having been a major oil and gas exporter has with a combination of

falling production and rising consumption become a net importer of both. Saudi

Arabia and Russia have nowhere else to turn once this crossover occurs.

Oil and gas importers have only 10 years or so to restrain oil and gas

consumption, while investing in renewable alternatives. The drive for wind, tide

and sea current generation will assist in the case of electricity, while the

time scale for nuclear power is too long even if there was sufficient uranium

production to fuel a “renaissance”.

There seems no other course of action other than “energy descent”. A

change of lifestyle is going to happen – it would be more appropriate for a

government to catalyse its introduction, instead of promoting roads and runways.

We all have to move about less.

John Busby 29 June 2008