Red

Face Book is an

analysis of the joint report by the OECD Nuclear Energy Agency (NEA) and

the International Atomic Energy Agency (IAEA) entitled: “Uranium

2007: Resources, Production and Demand”

Red

Face Book is an

analysis of the joint report by the OECD Nuclear Energy Agency (NEA) and

the International Atomic Energy Agency (IAEA) entitled: “Uranium

2007: Resources, Production and Demand”

The question of nuclear life cycle analysis in terms of energy inputs vs energy output is probably irresolvable. The final inputs are well after the generation ends and by then there will be little spare energy to manage the waste legacy. Even if the UK governments's nuclear liabilities fund is ample, it will not be able to command the means to deal with the residual problems. The energy output depends on how long the operational cycles endure and if the fuel runs out before the end there will be insufficient energy payback.

This is why the thrust of this argument focuses on the uranium fuel

supply which clearly has no chance of fuelling the so-called

"renaissance". As nukes are shut down and construction of

replacements are delayed, supplies will eke out, but the expansion

envisaged will simply not happen. The "holy grail" of breeders

is unattainable.

The nuclear lobby has won its case for the moment as the low carbon

nature of nuclear power is established in the media's and governments'

minds as genuine. For a typical response from the UK government

see the following Appendix 2.

Introduction by Chris Sanders of Sanders Research

Associates

The UK government’s determination to press ahead towards a nuclear future for the nation is a political posture that does not measure up to the facts on and in the ground. As a strategy for distributing public money and patronage it may make sense. A lot of money will flow long before any power does from the projected new fleet of reactors that is planned.

Nothing demonstrates this better than the government’s referencing the OECD/NEA and IAEA's “Red Book”, entitled Uranium 2007: Resources, Production and Demand in support of its own nuclear power policy. SRA’s energy analyst John Busby has taken a close look at the Red Book, leading us to conclude that:

• The government’s projections of global uranium supply are inadequate, inaccurate and misleading.

• There is no reason to believe that sufficient stocks of uranium will exist in the future to maintain existing levels of world and UK nuclear power generation, never mind forecast increases.

• As with world oil stocks, the issue is not one of existence, but of existence in sufficiently accessible concentrations so that the net energy input of the entire fuel cycle is actually low enough to ensure a net positive energy return on energy invested to make it worthwhile from an economic and social point of view.

In our view, the UK is facing outward towards an “energy cliff” that will be reached possibly as soon as five years from now. North Sea oil and gas production is falling at double digit rates; world conventional oil production is peaking (and, in our view, has actually peaked); it appears that world uranium production has peaked (2005) a second time, the first peak having been reached in 1980.

Fully 40% of current consumption comes not from mine production but from falling stocks. There are only two major projects worldwide at present, both of which are highly problematic from various standpoints: engineering, energy requirements (high diesel burn rates), geo-politics and security. In spite of intensive exploration efforts in recent years, no major finds have occurred.

This has major economic, market and political ramifications. From an economic point of view, a push to develop a “nuclear future” will divert scarce fuel and power resources from more productive uses. The most practical marginal source of power generation is from increased coal imports and coal power generation capacity rather than nuclear power generation capacity that will stand idle for want of fuel. Politically, the West is dependent on decommissioned Russian weapons grade uranium for its nuclear program, a finite source in the best of times, undependable in view of Russia’s own declining uranium production, and geopolitically fraught.

But the bottom line is that the fuel simply won’t be there.

Red Face Book, John Busby

The “Red Book” is a joint report by the OECD Nuclear Energy Agency (NEA) and the International Atomic Energy Agency (IAEA) entitled “Uranium 2007: Resources, Production and Demand” and is published every two years.

It claims to offer

“a comprehensive assessment of current uranium supply and demand and projections to the year 2030.” Also “available information on secondary sources of uranium is compiled and the potential market impact of this material is assessed.”

Though published in mid-2008 it “reflects information current as of 1st January 2007.”

Global aspirations

A quick look in Google News putting “nuclear power” in the search box, shows that many nations have aspirations for nuclear power. Oil-rich countries, realising that their main asset is running “down”, if not “out”, are candidates for the nuclear “renaissance”.

In 2008, there are some 439 power reactors operating providing 16% (372 TWh) of the world’s electrical generation, 35 are under construction, 91 are on order or planned and a further 228 are proposed. [2] The operational lives of some are to be extended, while many are due to be permanently shut down and decommissioned. However, taking all this into account, the Red Book assesses that nuclear generation will rise by 80% from the current 372 TWh to 663 TWh in 2030.

(See Table 27 on pages 65 and 66 of the Red Book)

The UK government wishes to see not just a replacement of its ageing reactors, but a doubling of its nuclear generation as the current fleet goes into decline, providing in 2007 only 15% of the UK’s electricity. It anticipates that the private sector will be able to raise the finance for a new fleet. At the same time, the government has put up a fund [3] to ensure that succeeding governments will avoid the costs of decommissioning and waste management a century later. For this optimistic belief to be realised, investors would need to be assured that the fleet could be fuelled for its full operational life of 60 years.

When confronted with the evident impossibility of a secure supply of uranium for even a fraction of the global nuclear aspirations, government agencies refer to the assurances of the “Red Book”, which concludes that “… sufficient nuclear fuel resources exist to meet energy demands at current and increased demand well into the future”.

(See last paragraph on page 89 of the Red Book)

The requirement is to fuel an expanding nuclear generating sector, not merely to maintain the status quo. It has never been questioned if enough uranium exists; the question is whether, as progressively ore grades decline, the aggregate of the energy inputs into the subsequent nuclear fuel cycle exceed the energy in the produced electricity. Unless there is a substantial net energy gain over the entire fuel cycle, the initial capital expenditure and running costs will not be justified. [4]

There will be a “cross-over” point, where at a particular low ore grade the energy inputs equal and then exceed the energy in the electricity produced. For a viable economic fuel cycle, ore grades well above the “cross-over” grade will be needed to yield an acceptable operational margin to justify the investment in mines, fuel manufacture, generating plant, decommissioning and waste management.

The Red Book attempts to establish the extent

of recoverable uranium resources extractable at costs below US$40/kgU,

US$80/kgU and US$130/kgU, from which analysis it claims that resources

of c. 3 million, 4.5 million and 5.5 million tonnes can be exploited. It

uses the criterion of less than US$80/kgU to create its Table 24 of

world uranium production ‘capability’.

(See Table 24 on page 48 of the Red Book)

The parameter “resources recoverable at costs up to …” is not an appropriate criterion. A particular resource needs to be assessed as to its ore grade and its local circumstances as to the energy input required. For instance, the depth of the resource below the surface determines the amount of overburden to be removed before reaching the ore and the subsequent ratio of rock to ore to be mined and milled. The ore grade also has an influence on the likely extraction yield, which decreases exponentially in accordance with it.

However, there is little point in contending with the Red Book’s assessment of the ultimate recoverable resources; it has little relevance to the future of nuclear power as the amount of 5.5 million tonnes is in any case inadequate to meet the global aspirations. Following the Red Book’s assessment of production ‘capability’, if taken up by 2030 half would be ‘recovered’ and by 2050 the other half would have been extracted.

Primary and secondary sources

Uranium for the manufacture of nuclear fuel is currently derived from two categories of supply, viz., 60% from primary natural uranium mining and 40% from secondary sources, comprising “excess government and commercial inventories, down-blended highly enriched uranium from the dismantling of nuclear warheads, re-enrichment of depleted uranium tails and spent fuel re-processing”.

The Red Book warns that secondary sources “are widely expected to decline in importance, particularly after 2013” and “reactor requirements will have to be increasingly met by mine production”.

(See paragraph 4 on page 11 of the Red Book.)

If this were to be compared with oil supplies, it would mean that 60% came from wells, while the other 40% was drawn from strategic stocks and re-conditioned engine sump oil!

Uranium requirements to 2013

An impending crisis in supply arises in 5 years time when the secondary sources are severely reduced from the equivalent of 25,000 tonnes down to 8000 tonnes per annum of natural uranium.

As shown in Figure 17 on page 86 of the Red Book, the world uranium demand in 2013 is expected to be between 73,000 tonnes and 82,000 tonnes U per year. The active mines in 2007 produced around 40,000 tonnes, so even if it is assumed that in 2013 they continue to produce the same 40,000 tonnes and the reduced secondary supplies indeed amount to 8,000 tonnes, a further 25,000 tonnes to 34,000 tonnes of increased annual production will be needed in five years’ time to meet the demand.

Uranium requirements to 2030

The Red Book has estimated that the prospective nuclear fleet in 2030 will require equivalent natural uranium production to increase to between 93,775 tonnes and 121,955 tonnes U per annum by 2030.

By 2030, the mines currently in production will have closed, so for the “renaissance” to be fuelled — and assuming 8,000 tonnes of secondary supplies is still then available — newly opened mines producing in aggregate between 86,000 tonnes and 116,000 tonnes a year will have had to be progressively opened from now until then. The Red Book insists that “mine expansions and openings must proceed as planned” without submitting the “plan” it insists should be met.

An acute supply problem is thus defined.

Production capability is not production

The Red Book defines production capability on page 396 as “an estimate of the level of production that could be practically and realistically achieved under favourable circumstances”.

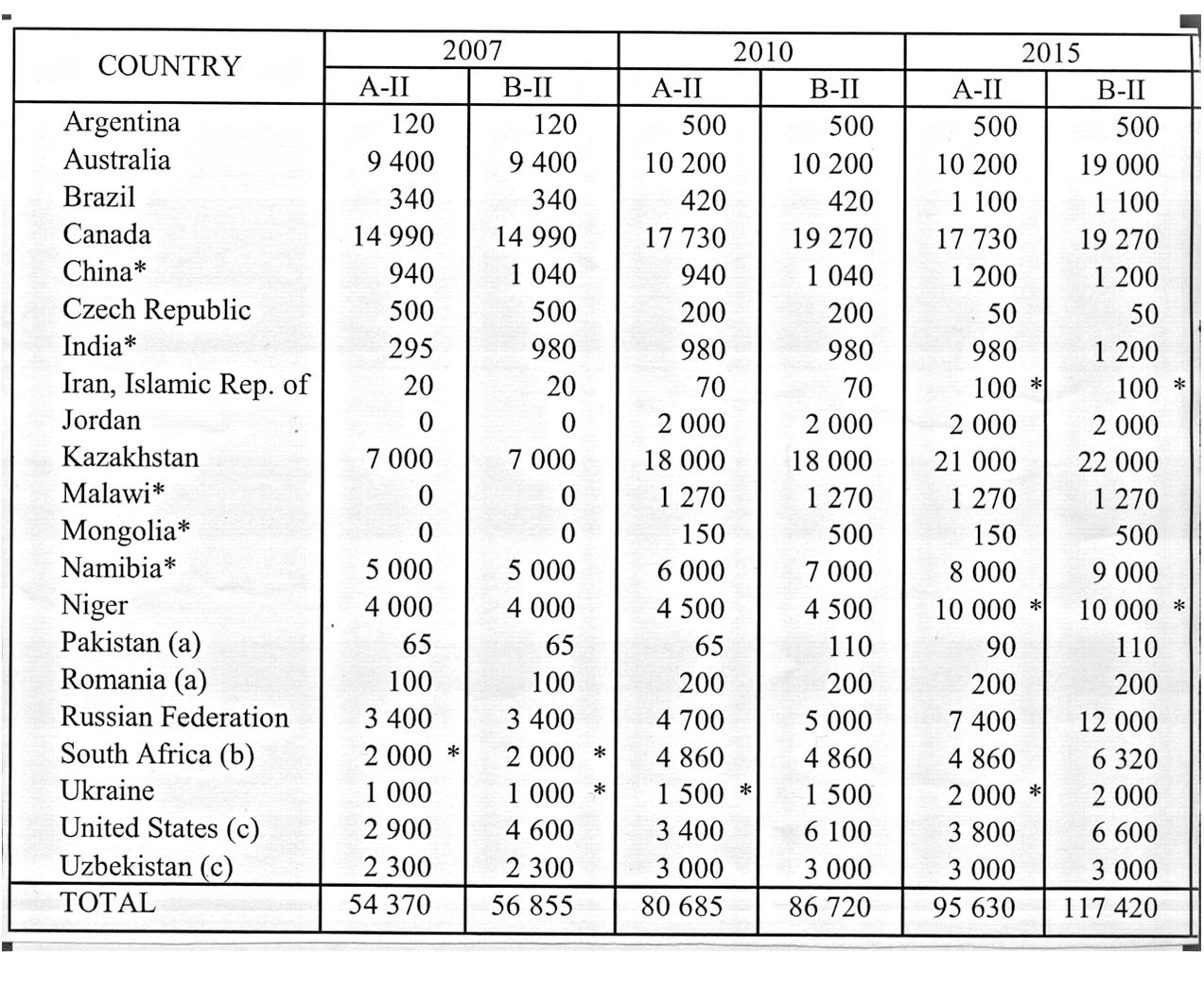

Table 24 on page 48 of the Red Book shows a rising world uranium production capability, from 54,370/56,855 tonnes in 2007 to 83,130/117,850 tonnes in 2030, assuming extraction costs to be below US$80/kgU. (The exactitude of this analysis to within 5 tonnes is perhaps unwarranted.) This ‘capability’ table is derived from responses from member countries currently producing uranium which were asked to provide projections of their production capability through 2030.

(See second paragraph on page 46 of the Red Book)

If this ‘capability’ could be realised it would just meet the production requirements through 2030!

The Red Book does however find in the last paragraph on page 11, that “for production to meet future demand, mine expansions and openings must proceed as planned and production will have to be maintained at full capability”

The title of this section “Production capability is not production” is found as a sentence in the last paragraph on page 85 of the Red Book, which admits that production has never exceeded production capability. It therefore concludes that “the secondary sources will continue to be necessary and uranium savings achieved by specifying low tails assays at enrichment facilities”.

So although the Red Book argues that the demand to 2030 can be met by a growing production 'capability', it is pessimistic as to whether sufficient mines will be opened to supply it. A further analysis of the secondary sources and enhanced enrichment facilities is necessary.

Secondary sources

The

principle secondary source, the Megatons to Megawatts US-Russian deal is

complex. Russian enrichment tails are re-enriched to 1.5% U-235

(remaining as UF6 gas), into which a stream of ex-weapons highly

enriched uranium (HEU) of 90% U-235 gas is injected to form a blended

low enriched uranium (LEU) of 4.4% U-235 ready for fuel manufacture,

which is shipped in cylinders to the US. The deal, which supplies 50% of

the US nuclear fuel requirement, the equivalent of 10,000 tonnes a year

of natural uranium, ends in 2013.

The

principle secondary source, the Megatons to Megawatts US-Russian deal is

complex. Russian enrichment tails are re-enriched to 1.5% U-235

(remaining as UF6 gas), into which a stream of ex-weapons highly

enriched uranium (HEU) of 90% U-235 gas is injected to form a blended

low enriched uranium (LEU) of 4.4% U-235 ready for fuel manufacture,

which is shipped in cylinders to the US. The deal, which supplies 50% of

the US nuclear fuel requirement, the equivalent of 10,000 tonnes a year

of natural uranium, ends in 2013.

It has been replaced (in February 2008) with another agreement which permits Russia to supply 20% of US reactor fuel until 2020 and to supply the fuel for new reactors quota-free. [5] However, Russian primary production is in deficit and it may well have little to spare after supplying its own stations and those of its nuclear allies, such as Bushehr in Iran.

The US has also released and will release ex-weapons HEU for conversion to LEU and for use in naval and research reactors. For power reactors, the Red Book anticipates a gradual release of LEU over 25 years, which can be interpreted from the confused discourse on this subject to amount to around 500 tonnes per annum of natural uranium equivalent. There appears to be a certain reluctance to release this material, partly because of its effect on the uranium market and perhaps because of a lack of processing capability in the USA.

As there was over-production of natural uranium up to the early 1990s there are inventories held by utilities, producers and governments, but the Red Book admits to uncertainty in regard to the magnitude of these. By subtracting the amount consumed by nuclear generators from the cumulative production, a figure of 625,000 tonnes U is derived, the majority of which was used for weapons.

Some countries have acknowledged stock levels amounting to around 40,000 tonnes natural uranium and 10,000 tonnes of enriched uranium (equivalent to 100,000 tonnes natural uranium). This suggests that the equivalent of 140,000 tonnes remains in national stocks.

(See Table 29 on page 76 of the Red Book)

Over the last 15 years a 25,000 tonnes demand deficit over primary production has been filled by the secondary sources. Russian ex-weapons LEU has provided the equivalent 10,000 tonnes per year of natural uranium, so that the equivalent of around 15,000 tonnes a year has been drawn from inven- tories, from mixed plutonium and uranium oxide fuel (MOX), from re-worked enrichment tails and reprocessed spent fuel.

From papers delivered to successive annual WNA symposiums and from the Red Book analysis, it appears that the contribution of the secondary sources will reduce to around 8,000 tonnes natural uranium equivalent after 2013. However. The Red Book admits “uncertainty remains” as to the level of inventories and the availability of uranium from the other secondary sources. Even if half of the cumulative surplus of production over power generation consumption could be deployed, i.e. around 300,000 tonnes, it would provide for only 4 years of the prospective demand.

Having forecast the reduction in the contribution of the secondary sources after 2013, it beggars belief that it nevertheless states that they will “continue to be necessary”.

(See last paragraph, page 11 of the Red Book)

Additional separative work units

More use of natural uranium can be achieved by installing additional gas centrifuges, the contribution of which is measured as “separative work units” (SWUs). The required U-235 is just a little lighter than the U-238 occurring in natural uranium, so to increase the U-235 content over that of the U-238, the small difference in atomic weight requires cascades of centrifuges in which the proportion of U-235 is incrementally increased in each individual centrifuge.

The use of additional SWU to make up deficiencies in uranium supplies was considered in a paper delivered to the WNA 2006 Symposium by Dr Thomas Neff, [6] in which he tried to pose an “equilibrium” amount of SWU respective to the price of uranium and the cost of the SWUs. The problem is that the number of centrifuges (SWU) needed to extract more U-235 from a decreasing tails content rises excessively. His conclusions were inconclusive.

World Nuclear Association (WNA) reported production

World uranium production in 2005, 2006 and 2007 as per WNA [7] is compared in the following table with the Red Book 2007 capability.

|

|

WNA

Tonnes U (7) |

Red

Book |

2006/2005 |

2007/2006 |

2007/2005 |

||

|

|

2005 |

2006 |

2007 |

2007 |

|

% |

% |

|

Canada |

11628 |

9862 |

9476 |

14990 |

-15 |

-3.9 |

-18.5 |

|

Australia |

9516 |

7593 |

8611 |

9400 |

-20 |

13.4 |

-9.5 |

|

Kazakhstan |

4357 |

5279 |

6637 |

7000 |

21 |

25.7 |

52.3 |

|

Russia |

3431 |

3400 |

3413 |

3400 |

-1 |

0.4 |

-0.5 |

|

Niger |

3093 |

3434 |

3153 |

4000 |

11 |

-8.2 |

1.9 |

|

Namibia |

3147 |

3077 |

2879 |

5000 |

-2 |

-6.4 |

-8.5 |

|

Uzbekistan |

2300 |

2270 |

2320 |

2300 |

-1 |

2.2 |

0.9 |

|

USA |

1039 |

1692 |

1654 |

4600 |

63 |

-2.2 |

59.2 |

|

Ukraine (est) |

800 |

800 |

846 |

1000 |

0 |

5.8 |

5.8 |

|

China (est) |

750 |

750 |

712 |

1040 |

0 |

-5.1 |

-5.1 |

|

South Africa |

674 |

534 |

539 |

2000 |

-21 |

0.8 |

-20.1 |

|

Czech Republic |

408 |

359 |

306 |

500 |

-12 |

-14.8 |

-25.0 |

|

Brazil |

110 |

190 |

299 |

340 |

73 |

57.5 |

172.1 |

|

India (est) |

230 |

230 |

270 |

980 |

0 |

17.4 |

17.4 |

|

Romania (est) |

90 |

90 |

77 |

100 |

0 |

-14.5 |

-14.5 |

|

Pakistan (est) |

45 |

45 |

45 |

65 |

0 |

0.0 |

0.0 |

|

Germany |

77 |

50 |

38 |

|

-35 |

-23.1 |

-50.0 |

|

France |

7 |

0 |

4 |

|

-100 |

|

-42.9 |

|

Total |

41702 |

39655 |

41279 |

56715 |

-5 |

4.1 |

-1.0 |

Far from reaching its Red Book 'capability', production in 2007 was only 73% of it. Although the 5% reduction in the production in 2006 over 2005 was somewhat reversed, the production level in 2007 was 1% below that of 2005.

Only Kazakhstan showed a significant rise in production, while Canadian production continued its decline to 18.5% below its level in 2005. The drop of 20% in Australian production in 2006 over 2005 was partially restored to 9.5% below that in 2005. The production from Kazakhstan is mostly destined for China, Korea and Japan and denied to US and European consumers.

If the trend in Canada and Australia continues, as anticipated, this has great significance to the US and France, the two major users with respectively 91% and 100% dependence on imported uranium. The drastic reduction in the secondary sources in 2013, particularly that of the Russian ex-weapons material to the US, will set both in competition for dwindling supplies. The situation will reflect that in India, where nuclear generation is running at half capacity for lack of uranium, in contrast to the estimated increase in indigenous uranium production reported by WNA.

Areva, the French mostly state-owned station builder and nuclear fuel manufacturer imports around 13,000 tonnes of uranium annually, 10,000 of which is for internal use, with the remainder used to manufacture fuel for its external ‘hegemony’, which includes the countries in which it has built and is building nuclear stations and the UK’s Sizewell B reactor. If supply fails to met demand in the near future, (as warned in the first paragraph on page 12 of the Red Book,) the lights are most likely to go out in those countries dependent on French production before those in France itself.

It can be presumed that once the deficient supply situation is better understood, the UK will abandon its nuclear aspirations and will not be subject to another country’s hegemony!

Cigar Lake and Olympic Dam

It has been shown that between 86,000 tonnes and 116,000 tonnes of new primary production is required in 20 years time. Two prospective mines — one in Canada and one in Australia, the principle supplier countries — together could provide 20,000 tonnes of annual production. There are no other prospective mines capable of producing at this level.

If it goes ahead in 2011, the flooded Cigar Lake in Canada is expected to eventually produce 7,000 tonnes a year. Meanwhile, the delayed Olympic Dam expansion project in Australia (if it goes ahead as originally promoted) is expected to produce up to 12,720 tonnes a year in 2015, not 2013 as on page 47 of the Red Book.

The underground Cigar Lake mine requires constant ground refrigeration above and below the workings to stem water ingress. This has to continue after the mine has been pumped dry and production commences in 2011. The future of this mine, although endowed with the world’s highest ore grades, can only be considered as doubtful.

The Olympic Dam expansion as an open pit is dogged with low grades for all of its combined ore containing copper, silver, gold and uranium. But worse, the resource is below 350 metres and requires 4 years of prior excavation before the ore body is reached and can be extracted. Australia is a net importer of diesel and the feasibility of the project is prejudiced by the impossibility of pricing the necessary 6 million tonnes of diesel needed to excavate the overburden, which must feature as a major capital cost. Worse still, the owners are requesting permission to forego uranium extraction and to export copper concentrate un-smelted, in which the uranium will be a contaminant. China is the most likely recipient of the copper and may well be willing to extract the uranium for its nuclear sector, denying it to Australia’s present external customers.

On the eventual success or failure of these two, the only major prospects in view, depends the continuation of nuclear generation at its current level. Even so, more such would be required to fuel the expansion envisaged.

The feasibility of the Olympic Dam expansion is considered in articles in SRA’s Real Resources Review, “The big hole ” and “An even bigger hole”.

Canadian individual mine production

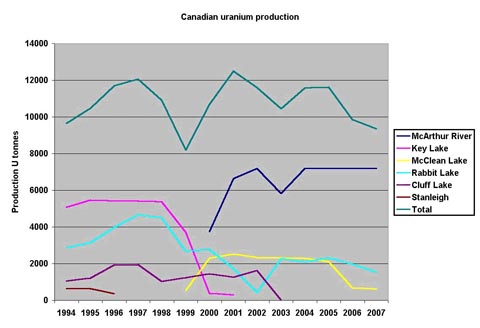

The profile of individual mine production figures can be understood by plotting the published results as below:

From the plot it can be noted that mines open, production rises and “platforms”, then declines and then closed. This was the case with the Stanleigh, Key Lake and Cluff Lake mines, while the McClean and Rabbit Lake mines are in decline. Only McArthur River is in full production so that the 18.5% fall in the total production in two years is clearly seen. For production to have been maintained at its 2005 level, the new Cigar Lake mine should have been initiated then; but, in fact, its projected start in 2007 would have been too late. It is unlikely to open until 2011, if it starts at all; but if it does it will merely replace the production from the McArthur River mine once it, in turn, has entered its decline phase.

For production to be maintained, a succession of new mines has to be timely opened to replace that from the closed mines and those with production tailing off; for production to rise, the number of adequately endowed mines to be opened has to be much greater. For Canada to achieve its Red Book production ‘capability’ of 19,720 tonnes per annum in 2030, another two mines the size of Cigar Lake would have to be opened before then, plus Cigar Lake itself, which by then would then be in decline.

The long-term perspective

In its Appendix D “The long-term perspective”, the Red Book considers future prospects and potential uses for nuclear power, but its “capability” analysis only encompasses a period up until 2030. If reactors are commissioned in the UK from 2017 as planned, fuel supplies must be guaranteed until 2077 and beyond to cover their anticipated operational life of 60 years. The Red Book gives no view as to the uranium supply situation for a critical half century from 2030.

A defensive OECD/NEA issued a press release on 3 June 2008 [8] in which it led with the following statement:

“There is enough uranium known to exist to fuel the world’s fleet of nuclear reactors at current consumption rates for at least a century …”

But this is not the world’s requirement or even that proposed in the Red Book, which is to add 37% to 78% of nuclear generating capacity to that in 2007 of 372 GWe, requiring 94,000 tonnes to 122,000 tonnes per year of natural uranium by 2030. In fact, the current consumption rate is to be doubled.

Given the anticipated expansion of nuclear capacity and the need to inform decision makers of the security of fuel supplies, this opening statement heading the press release is deceptively reassuring. Further down in the text of the release is an admission that the secondary sources are in decline and the gap they fill needs to be supplemented by the opening of new mines. The long lead times to bring in new production is indeed mentioned, but the need to triple primary production within 15 to 20 years, while accepting that the existing mines will be closed by 2030, fails to be highlighted.

There has indeed been a Klondike-like frenzy of exploration, but few new discoveries of significance have been found. The progressive rise in annual 'capability' was assessed as the aggregate of the producer country responses is not based on an independent review. No reference is made to economic “cut-off” ore grades in respect to the energy inputs needed and the extraction yields at the lower end of the grade spectrum.

(See Table 24 on page 48 of the Red Book)

Apart from Cigar Lake and Olympic Dam, no potential mines of sufficient size have been identified. Those mines that are near opening are incapable of fuelling the renaissance. The Red Book has in fact given a pessimistic view of the likely take up of the ‘capability’ it claims to have revealed, a view justified by the course of events.

The long-term perspective section is somewhat different in that it reviews possible technological advances in fast reactors, hydrogen production for transport and recycled fuel. It envisages nuclear energy availing for hundreds to thousands of years, while failing to answer the question as to whether the nuclear “renaissance” of the scope detailed in the press release and promoted ad nausea by the nuclear lobby can be fuelled in the next twenty years up to 2030.

Dissentient conclusion

The Red Book, although issued in mid-2008 was in fact dated 1st January 2007. It failed to record the actual uranium production figures for 2007 — now well passed. Had it done so it would have revealed the stagnation: production in 2007 was 1% less than that in 2005. Indeed, 2005 may prove to have been the second and last peak year in global uranium production.

Production in the two main supplier countries of Canada and Australia exhibited catastrophic decline due to the normal rise in production, its peaking and subsequent decline, exhibited in the life cycles of individual mines, the aggregate of which will eventually form a final world production peak. The second in 2005 may have been the final, the first occurring in 1980.

A shortage is supposed to lead to a rise in price, which in turn gives incentive to exploration and exploitation. But decreases in ore grade, as characterised by those encountered in Australia, require an increase in the ore quantity and its overburden, requiring a parallel increase in the input energy. This is particularly significant in Australia where diesel is a net import, so that its cost is a major factor in the size of the prior capital expenditure and subsequent running costs.

In comparison, the price of gold has soared, but even this massive rise has failed to increase its production which peaked in 2001. The production costs due to lowering ore grades and the rising price of diesel being the main factors.

The current increase in the price of oil, supposed to give incentive to investment in nuclear power, has caused the capital costs of the new build and the price of its fuel to rise beyond the financial parameters analysed so far. In a recession led by the oil price hike, it is now beyond the capability of the private sector to finance a nuclear “renaissance”, if it ever was within it.

But if the private sector is brought to the verge of financing a new UK nuclear fleet by political pressure, it will not be persuaded of the sufficiency of its uranium fuel if when exercising its “due diligence”, it examines the claims of the flawed Red Book and it will demur.