Heathrow Financing

Preamble

Heathrow airport was acquired in 2006 by FGP Topco Limited from BAA plc together with the other main UK airports, which were later sold. The acquisition and subsequent capital spending was and is financed by debt.

The debt financing of Heathrow is attained by the issuing of bonds, around 80% of which are issued offshore by FGP Topco's subsidiaries Heathrow Funding Limited in Jersey and onshore Heathrow Finance plc in London, which issues the other 20%. The ultimate parent of 12 main airport subsidiaries FGP Topco Limited is burdened with £14 billion of debt, which with the addition of the interest pending has an attributed "fair value" of £16 billion.

Heathrow Funding Limited's Base Prospectus 2017 (1) requires that the bonds have a minimum rating by

the rating agencies S&P, Moodys and Fitch. The S&P Direct

Ratings Summary (3) states that its rating depends on the continuation of the CAA

"regulation environment". Heathrow's Regulatory Asset Base, on which the

airport charges are price capped, takes into account capital

spending and its financing costs, included in seven "building blocks".

Over the decade of FGP Topco's ownership, Heathrow's airport charges have kept pace with the financial costs of Heathrow's capital expenditure and have risen from around £8 to £22 per passenger. In the February 2018 Transport Committee's hearings the airlines, in particular IAG and Virgin Atlantic, have declined to pay additional charges, which if the current "regulatory environment" continues will rise automatically. Unless this continues the bonds may be insufficiently rated and the financing of the expansion with the addition of more debt may not succeed. If, nevertheless, the current CAA regulation continues, the airport charges may well double and the major airlines will exercise their threat to use other hubs, which charge only around a third of the current Heathrow charges.

The Airports Commission's estimate of the costs of three expansion variants are

shown in its Table 11.2 on page 224 of its report. It estimated that the

preferred NW runway's capital costs total £47.5 billion, comprising the runway

scheme £17.6 billion, core capital £13.4 billion plus asset replacement £16.5

billion. The core capital and asset replacement are to be spread over 30

years, as is the operating expenditure of £49.9 billion. The surface access

costs were estimated at £5 billion, but Transport for London (TfL) raised this

to £18.6 billion. There was dubiety over the responsibility for paying for the

surface access costs. At 2014 prices, the capital costs with

operating expenditure and surface access costs totals £102.5 billion. With 10%

inflation this is now £113 billion.

The airport would have to generate surpluses of around £4 billion a year over 30 years. With a possible turnover of £5 billion, the potential operating profit, once the airport is expanded, (and without raised airport charges) will be around £1.7 billion. It will be impossible to cover the increased financial costs if debt financing is to continue and is to continue to pay dividends out of its borrowings. The regulated airport charges only apply to the aeronautical income, which in 2018 was just £1.745 billion, just 60% of the total revenue of £2.874 billion. Without increased charges of around double the current, the runway cannot be funded.

Distributed over the 13 main companies in FGP Topco's group there is apparently

a considerable sum in the profit and loss reserves, which in

2018 totaled £23 billion. The subsidiaries' accounts are supposed to be

consolidated in the top company, but the sum in FGP Topco's profit and loss

account is just £1.695 billion. If not consolidated and the £23 billion is

reserved, even this massive sum is insufficient to make the expansion a

viable project. Costs are now claimed to be at least £30 billion and may reach

£50 billion. Over its 12 years of ownership, with the payment of interest,

dividends and with financial instrument losses, FGP Topco at the end of 2018

achieved a deficit of over £1 billion with borrowings of a "fair

value" of £16 billion.

FGP Topco's paid up shares total only £13.1 million and the acquisition and subsequent capital expenditure over the decade of its ownership has been entirely covered by issuing bonds and the annexation of the entire operating profits over the years has covered the financial costs. There is an alternative of insisting that FGP Topco raises a cash equity stake of perhaps £30 billion, but this is not in accordance with its current methodology, which is to borrow and pay in miniscule cash equity. In any case, Heathrow generates an insufficient gross margin to support the costs of any expansion more than a moderate upgrade of its facilities.

But the real problem for Heathrow is that the third runway is not needed to accomplish the desired 50% expansion in Heathrow's business, which is already underway with the deployment of bigger aircraft. There is clearly no economic case for the accompanying destruction of so much local housing, businesses and assets, such as the Lakeside EfW or BA's Waterside HQ complex, or for the expenditure for the runway itself while its business is expanding without it. There is no compilation of the great number of businesses, premises and sundry assets that will be affected and the costs of their re-location. The tunnelling of the M25 and the diversion of the airport peripheral roads will not only be hugely expensive, but will reduce access to the airport just when it needs revenue to fund the expansion.

FGP Topco Limited had no mention in the Airports Commission report, nor in the evidence transcripts of the Transport Committee sessions on 5, 7 and 20 February 2018. Ferrovial's Jorge Gil signs off FGP Topco's financial statements and should have been called to give evidence to the Transport Committee's hearings. The discussions with the CAA regulator, Andrew Haines were inconclusive.

FGP Topco's finances are in a net current liability position with no real net assets over its liabilities. It may be that its existence as the top company consolidating Heathrow's accounts is best ignored. See extract from FGP Topco's annual report 2018 and 11-year summary 2007-2018 in Figure 8.

Figure 1

In the Equity summary the share premium entry £1,411 million represents the value of the shares after Ferrovial sold 37% of its holdings, but in a liquidation would be valueless. FGP Topco Limited is technically bankrupt and continues only as a "going concern" as in its financial statements.

BAA plc

British Airports Authority was privatised as BAA plc in 1987.

FGP Topco Limited

In 2006 BAA plc was purchased by FGP Topco Limited for £10.277 billion, with £2.855 billion, followed with internalised borrowings of £7.392 billion. (£2.885 is 27.78% of BAA's shares and 2.885/0.2778 = 10.277). The down payment of £2.855 million was later recovered by further internalised borrowings.

The shareholders of FGP Topco Limited in June 2006 were:-

Ferrovial Infraestructures SA 62% (Spain)

Caisse de dépôt et placemont du Québec 28% (Canada)

Baker Street Investment Pte 10% (Singapore)

FGP Topco initially had three finance subsidiaries, ADI Finance 1 Limited, ADI Finance 2 Limited and Airport Development and Investment Limited (ADIL). ADIL then wholly owned BAA plc, thereafter de-listed as BAA Limited. BAA plc annual reports up to 2005/06 can be found on the Companies House web under LHR Airports Limited. ADIL was then renamed as BAA Limited in 2008, later further renamed as Heathrow Airport Holdings Limited.

Post-acquisition financing figures (extracted from page 9 of the FGP Topco Limited 31 December 2006 annual report)

Gross debt at 31 December 2006 was £13,515 million following the financing of the acquisition of BAA plc, while at 25 June 2006 it was just £2,861 million.

Movement In gross debt £ million

Gross debt at 25 June 2006 2,861

Debt converted to equity (2,861)

Gross debt acquired 5,939

Increase in borrowings under various facilities 7,576

Gross debt 31 December 2006 13,515

The acquisition of BAA by FGP Topco added £10,654 million to its gross debt.

Disposal of airports other than Heathrow

By December 2014, due to a ruling by the Competition Commission, Gatwick, Stansted, Glasgow, Aberdeen, Edinburgh and Southampton airports had been sold for a total of ca. £4.8 billion. £670 million from the proceeds augmented the dividend to the shareholders in 2014. It may be that some of the proceeds were used by Ferrovial to take shares in Aberdeen, Glasgow and Southampton airports.

Heathrow's structure at end of 2006

Figure 2

Simplified Structure of FGP Topco and its subsidiaries at 31 December 2006

The total of notes, loans and bonds above is the £13.515 million gross debt. It appears that the acquisition of BAA was achieved entirely by internal debt, as the initial payment of £2.885 million was made by Airport Development and Investment Limited having borrowed £6.645 million in loans.

Heathrow's structure in 2015

FGP Topco Limited is the ultimate owner of Heathrow, heading up 12 main subsidiary companies, as listed below in 2015.

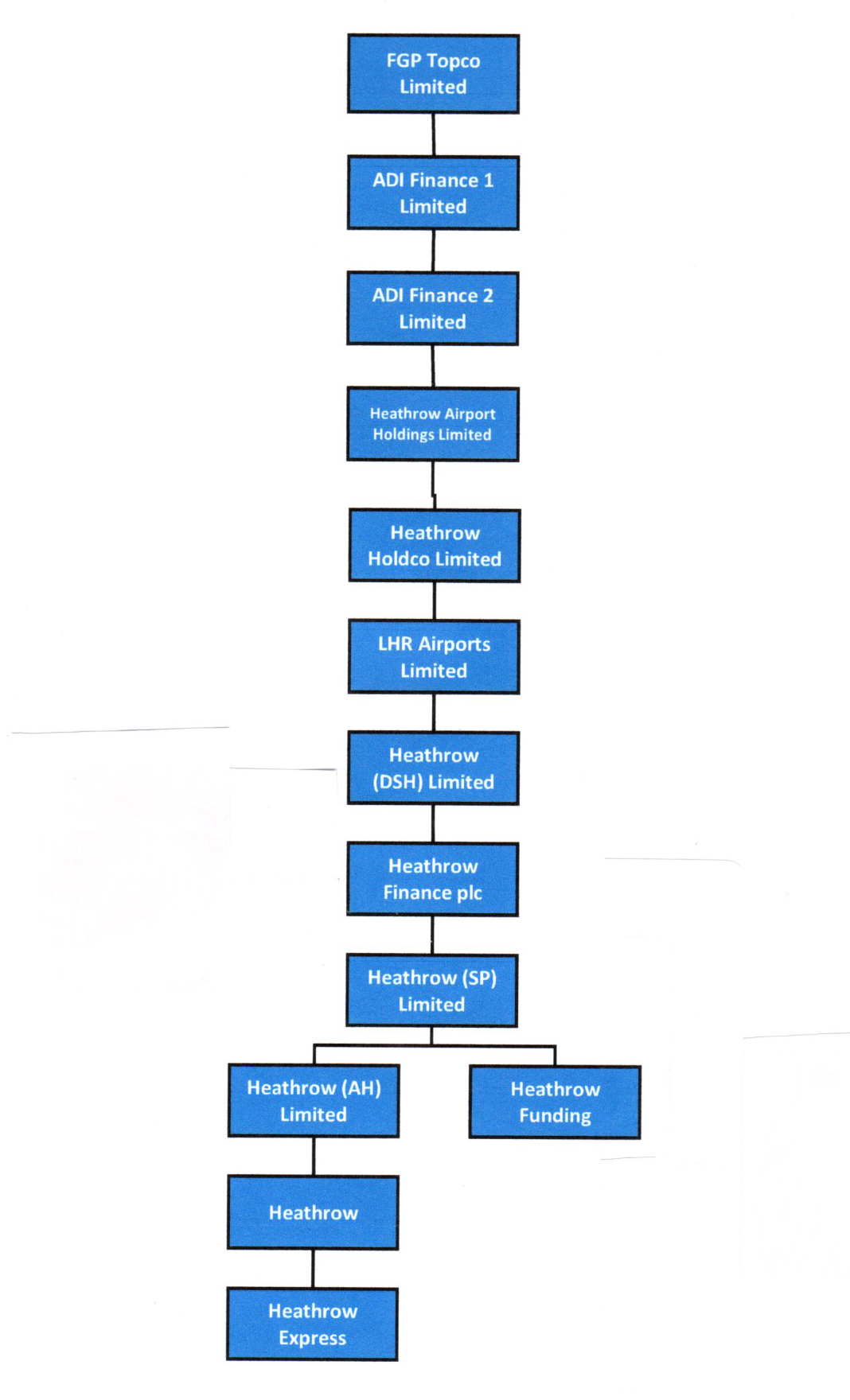

Figure 3

There are four finance companies in the current structure, ADI Finance 1 Limited, ADI 2 Finance Limited, Heathrow Finance plc and the offshore Heathrow Funding Limited registered in Jersey. Heathrow Funding Limited was once BAA Funding Limited, from which Gatwick Funding was split off. The last but one in the company structure is Heathrow Airport Limited which holds the CAA licence.

FGP Topco Limited in 2018 is a 90% foreign-owned holding company and its shareholdings have changed.

| Owner | Shares |

|---|---|

| Ferrovial | 25% |

| Qatar Holding | 20% |

| Caisse de dépôt et placement du Québec | 12.62% |

| Government of Singapore Investment Corporation | 11.20% |

| Alinda Capital Partners | 11.18% |

| China Investment Corporation | 10% |

| Universities Superannuation Scheme | 10% |

FGP Topco Limited's Directors

British Stuart Baldwin, Robert Horsnall*, Alexander Leonard, Michael Powell

American Christopher Beale, Samuel Coxe, David Xie

French Olivier Fortin

Canadian Eric LaChance

Chinese Benjamin Bao

Spanish Jorge Gil Villen, Inigo Meiras

Qatari Ahmed Al-Hammadi, Deven Karnik

*Universities Superannuation Scheme

The financial statements in its annual reports are signed off by Ferrovial's Jorge Gil.

Paid up shares

FGP Topco's paid up shares amount to only ca. £13 million, while the capital for airport works is raised by issuing bonds totaling ca. £14 billion, around 20% of which are issued by Heathrow Finance plc and 80% by Jersey-based Heathrow Funding Limited. The initial borrowings, raised to £13 billion to fund the acquisition of BAA plc, were raised further by another £1 billion to £14 billion.

Annual returns published in Companies House show that FGP Topco has paid up shares of £505m in ADI Finance 1, which has paid up shares of £3812m in ADI Finance 2, which has paid up shares of £2666m in Heathrow Airport Holdings, which has paid up shares of £466m in Heathrow Holdco, which has paid up shares of £6309 in LHR Airports, which has paid up shares of £2177m in Heathrow (DSH), which has paid up shares of £3109m in Heathrow Finance plc, which has paid up £11 million of shares of in Heathrow (SP), which has paid up shares of £11m in Heathrow (AH), which has paid up shares of £10m in Heathrow Airport, which has paid up shares of £4 in Heathrow Express Operating Company Limited.

The significance of paid up shares in a subsidiary wholly-owned by another above it in the structure is unclear.

Twelve years of FGP Topco Limited

Twelve of FGP Topco's annual reports, from its conception in 2006 up to the end of 2018, were analysed to get the total of the dividends it paid to its shareholders, the amount of interest it paid on the bond financing and the amount of the net tax credits. Credits were earned in six years of the ten when the interest paid and costs of the financial instruments exceeded the operating profit.

The dividends paid to the shareholders from borrowings totaled £4.12 billion and the net tax credits amounted to £693 million. (Further dividends of £600 million were paid in 2019). Assuming that 80% of the finance was raised offshore and thereby withholding taxes of 20% avoided, a rough calculation was made to assess the withholding tax avoided, i.e. £7,034 million x 0.8 x 0.2 = ca. 1 billion.

Figure 4

The table below was from an Excel worksheet with the annual reports' figures.

In 2019 FGP Topco's shareholders have since received another £600 million, adding up to £4.12 billion in dividends since its inception in 2006..

Interest payments

In 6 of FGP Topco's twelve years the interest payments on borrowings, together with losses on financial instruments, have led to costs exceeding the operating profit and leading to a loss. The company survives as a "going concern"

Tax credits

In the successive annual reports there are complex taxation calculations, but essentially the financial mode of operation has led over the twelve years from 2007-2018 to the creation of £693m in net tax credits against the taxpayers' expectations and a possible loss of bondholders' withholding tax of around £1 billion.

Borrowings

By 31 December 2018 FGP Topco's total borrowings were £14,502 million.

Figure 5

FGP Topco's 2016 "dividend" trail

In 2016 Heathrow Airport paid a "dividend" of £594m to Heathrow (AH) from "Retained Earnings".

Heathrow (AH), added £2m to it and paid a "dividend" of £596m to Heathrow (SP) which stated that it passed £596m to Heathrow Finance plc, but which is unaccounted for in Heathrow Finance plc's annual report of 2016. Heathrow Finance plc paid a "dividend" of £616m to Heathrow (DSH) which paid £616m to LHR Airports.

LHR Airports subtracted £88m from the £616m from Heathrow (DSH) and paid a £528m "dividend" to Heathrow Holdco, which paid Heathrow Airport Holdings the £528m.

Heathrow Airport Holdings added 12m to its "dividend" payment of then amounting to £540m to ADI Finance 2.

ADI Finance 2 added a £4m tax credit to the £540m input from Heathrow Airport Holdings, paying £513m into its profit and loss reserves and met £13m of its finance costs. It then drew £325m from its profit and loss reserves for remittance to ADI Finance 1 which met £33m of its finance costs, paying £292m into its profit and loss account.

The "dividend" initiated from Heathrow Airport encountered payment inputs and outputs, before finally finding its termination on the profit and loss reserves of ADI Finance 2 and ADI Finance 1, losing £302m on the way! The so-called "dividends" were inter-subsidiary monetary transfers.

The actual £325m dividend to the shareholders was paid out of an issuance of bonds by FGP Topco, i.e. paid out of its borrowings. (See page 36 of its 2016 accounts). The consolidated accounts of FGP Topco show a loss of £113m, from which a dividend could only originate in borrowings. However on page 93 of its 2016 accounts it states that the dividend was paid from a profit and loss reserve, at the end of the year standing at £2.303 billion, augmented by a "profit" of £33 million, while suffering a loss of £113m and enjoying a tax credit of £65 million (See page 11).

In subsequent years a similar passing of what is erroneously termed "dividends" up the chain of subsidiaries occurs. What is unsatisfactory is that not every upward transfer is clearly noted in the accounts of the receiving subsidiary.

Heathrow Funding Limited (HFL)

Of the four finance companies in the Heathrow group, Heathrow Funding Limited is registered offshore in Jersey. It originated as BAA Funding Limited when BAA was privatised and was split off when airports other than Heathrow were sold off.

Its activity is the issuing of bonds, the interest of which is free of withholding tax, see its prospectuses. In its annual reports it also engages in financial instruments. However the company in Jersey has no employees, so its activities must originate in the UK.

HFL receives a finance income comprising, interest receivable from group undertakings, plus interest receivable on derivatives. From the financing income it pays interest payable on external borrowings and interest payable on derivatives. The difference between the financing income and finance costs is HFL's operating (loss)/"profit". This is marginally taxed as a "securitisation" company. In 2014 this "profit" of £82 million was minimally taxed at £8,600.

The HFL 2016 annual report was held back for "re-measurement". When scrutinised it appeared that the finance income and and cost figures in the 2016 annual report for 2015 were different from those originally entered in the 2015 version.

Figure 6

See the table below.

From 2010 until and including 2014, HFL's finance income was between £435m and £666m, while in 2015 before "re-measurement" it was £565m. In 2016 this rose to £1,019m, a step change of 45%.

HFL's virtually untaxed "profits" in 2014 and 2015 were £82 million and £13 million, but its 2016 first half-year unaudited report published on 30 November 2016 showed an untaxed "profit" of £75 million. HFL's full year report was belatedly published on 2 August 2017 and shows a loss of £72 million, a reduction of £147 million in its half-year profit.

However, HFL's losses/"profits" are the difference between what it was paid to it by the operating companies of the interest paid on their borrowings (and on the interest paid for derivatives) and what it actually paid in interest to its bondholders (and derivative providers).

The profits and losses go into a Profit and Loss Reserve which in 2016 stood at -£23 million, which if the £75 million half year "profit" had extended into the full year would have held £199 million.

Profit and Loss reserves

In FGP Topco and each of the subsidiaries there are Profit and Loss reserves.

Figure 7

These are listed in the table below.

There is no explanation as to why these large sums have accumulated in the Profit and Loss reserves of FGP Topco and its main subsidiaries into the colossal sum of £22.883 billion.

In page 35 of FGP Topco's 2018 consolidated accounts the equity assessment takes into account "Other Reserves" of -£262 million and "Retained earnings" of -£159 million, but not the P&L Reserves of £1,695 million entered in in Note 7 on page 92. The accounts of the Heathrow top company and entire subsidiaries are to consolidated into FGP Topco Limited as the ultimate parent entity and parent undertaking as on page 93 of its annual report 2018

Figure 8

The revenue, operating costs, dividends, interest paid and financial instruments costs from 2007 to 2018 were totaled and tabulated to establish the origin of the P&L Reserves.

After acquisition of BAA by FGP Topco Heathrow's borrowings were around £13 billion and now are around £14 billion, so it would appear that the deficit of £1,260 million has been covered by extra borrowing.

This is an oversimplification as the sale of Stansted raised £1,500 million of which £670 million augmented the dividend paid in 2014. Gatwick was sold for £1,510m, Edinburgh for £807m, Aberdeen, Glasgow and Sopithampton for £1,05m with overall gain of £4,862m for FGP Topco with Stansted.

The origin of the £1,695m in 2018 or the whole £22,883m in the summed P&L Reserves, if it exists is subject to examination.

Heathrow's borrowings

Heathrow's subsidiary Heathrow Finance plc in 2016 reported that bond financing was issued around £14 billion, of which £11.5 billion was issued offshore in Jersey by Heathrow Funding Limited, around 80% of the funding.

In its 2013 prospectus Heathrow Funding Limited states:-

The Issuer believes that all payments made under a Borrower Loan Agreement can be made without deduction or withholding for or on account of any UK or Jersey tax.

If the bonds were issued in the UK, the interest paid to UK bondholders would be subject to "withholding tax" of 20%, which would mean they would require a higher interest rate than would appertain if issued offshore.

However, in its 2017 prospectus the onshore Heathrow Finance plc in an assuagement for its bondholders states:-

All payments by or on behalf of the Issuer under or with respect to the Notes will be made free and clear of and without withholding or deduction for or on account of any present or future Tax imposed or levied on such payments by or within the United Kingdom or by or within any department, political subdivision or governmental authority of or in the United Kingdom having power to tax (each, a “Relevant Taxing Jurisdiction”), unless the Issuer is required to withhold or deduct Taxes by law. In that event, the Issuer will pay additional amounts (“Additional Amounts”) as may be necessary to ensure that the net amount received by each Noteholder and Couponholder after such withholding or deduction (including any withholding or deduction in respect of any Additional Amounts) will not be less than the amount the Noteholder or Couponholder, as the case may be, would have received if such Taxes had not been withheld or deducted.

So if Heathrow Finance plc is constrained to subtract withholding tax from its interest payments to its bondholders, it contracts to pay additional amounts in compensation.

S&P RatingsDirect 12 February 2018 (3)

S&P Global rates Heathrow A-/Stable with low business risk, but with an "aggressive" financial risk.

The business risk relies on:-

A supportive regulatory environment, ensuring recovery of investment and good predictability of cash flows over five-yearly resets.

The financial risk is:-

Aggressive leverage and relatively weak credit metrics, a negative operating cash flow from FY2019 due to increasing capital investment and the default risk of notes issued by Heathrow Funding Limited by allowing the shareholders to take control of the business ahead of an insolvency of Heathrow (SP) Limited.

The airlines, particularly IAG and Virgin Atlantic are refusing to pay additional airport charges, charges which rise automatically by the exercise of the CAA in its "regulatory environment".

The notes issued by Heathrow Funding Limited absolve the holders from paying withholding tax, so if HM Treasury insists that the replacement bonds of those that mature pay withholding tax, the required interest payable on the replacement bonds will rise in compensation.

The S&P RatingsDirect (3) was issued on 12 February 2018 before the Transport Committee hearing on 20 February 2018 in which the airlines refused to pay additional airport charges to fund the expansion. This means that the business risk can no longer be based on a supportive "regulatory environment" and S&P needs to take this into account.

Autumn Statement 2016

In his Autumn Statement in 2016, the Chancellor of the Exchequer, avowed to stop what he sees as tax avoidance by the failure to pay UK tax on offshore interests. If he attains his aim, it means that Heathrow will have to issue its bonds in the UK making them less attractive to prospective bondholders with a consequent raising of interest rates or be subject to compensation claims if withholding taxes are levied prior to payment.

Also bonds mature and those currently issued offshore will, when matured, have to be replaced by UK issued equivalents at a higher interest rate to compensate for the paying of the withholding tax.

If HM Treasury insisted that the whole £11.5 billion issued bonds offshore be replaced by UK equivalents it would be problematic for Heathrow. What could be a solution is for offshore issues, once matured, to be replaced by an onshore issue paying withholding tax. It would take some years for the replacement of the offshore issuances with onshore issuances, but would ease the situation somewhat for Heathrow, while adding to the tax take. A recent bond issue will not mature until 2058!

Funding Heathrow's expansion

Due to the interference to its business of the infrastructure

activities, such as diverting the M25 in a tunnel under the runway (or by the

building of a bridge over the M25), Heathrow's revenue will be reduced. It

may then not be able to service its current debts, let alone

the additional borrowings for the new runway. IAG has refused to pay

additional airport charges to support the expansion expenditure as it has

already invested in bigger aircraft to increase its traffic, so that it is

reluctant to invest in a runway it doesn't need.

The taxpayer is expected to fund the £5 billion supporting surface access infrastructure

needed as "state aid", though the "airport operator would be

expected to contribute some or all of these costs". (See Airports

Commission 11.4 ii), page 222. However, Transport for London estimates the surface access

costs at £18.6 billion.

The Airports Commission in its Table 11.2 on page 224 added to its assessment of the capital expenditure £13.4 billion core capital expenditure and £16.5 billion asset replacement costs to the £17.6 billion Heathrow expends on the runway. This comes to £47.5 billion, which with the £5 billion surface access costs gives a total of £52.5 billion. If TfL is correct then another £13.6 billion is required making the total £66.1 billion. Heathrow is expected to raise £47.5 billion while the taxpayer is expected to raise £18.6 billion of the £66.1 billion.

The Airports Commission also added in Table 11.2 operating expenditure of £49.9 billion for the ongoing and future operations of the airport. The core capital expenditure and asset replacement costs together with the operating expenditure are levelled over 30 years or so. These were 2014 figures and are subject to perhaps 10% inflation.

There is yet an omission in that the interest charges on borrowing to pay the progress payments to the runway building contractors could be considerable, especially as BofE interest rates will soon be lifted. There could easily be another £7.5 billion in interest charges over the construction period.

The airport revenue in 2018 is expected to be £2.9 billion. The 2017 operating profit of £1.2 billion is already mostly taken up by financial costs of £1 billion on its current £15 billion borrowings.

With no increase in airport charges, the revenue would be raised by 50% at the end of the expansion to just £4.35 billion at current prices, say £5 billion with inflation, with the operating profit rising with the expansion perhaps to £1.7 billion?

The £22 billion in reserves, if still existing and not drawn by offshore owners, is insufficient to meet Heathrow's £47.5 billion share of the whole project. Taxpayers would not be compensated for meeting the surface access costs if Heathrow continues to avoid paying corporation tax and gets tax credits.

As the current, mainly offshore bond funding of the expansion leads to the avoidance of corporation and withholding tax and to the procurement of tax credits, the taxpayer will fail to get a return on the investment in the connecting and supporting infrastructure.

In any case the current financial arrangements are unlikely to be able to fund the runway and the expansion of Heathrow's facilities without increasing airport charges, which it pledges will not rise and which airline operators will decline to pay.

Ferrovial sold 37% of its initial 62% shareholding for £522m leaving it with just 25% majority shareholding in FGP Topco Limited, Its Jorge Gil is Heathrow's CEO and its Javier Echave is its finance director.

The £10 billion acquisition facilitated by £7 billion of borrowings by the acquired object, the shareholders have recovered their initial investment of just under £3 billion in further borrowings by the acquired BAA and in effect the buying consortium got it for free. Since then its shareholders have got another £4 billion in dividends paid from borrowings, not earned from profits, as a huge ain from the initial paid up shares of just £13.1 million.

This methodology is unlikely to continue and a real cash equity input will be required. FGP Topco will be unable to raise the considerable equity needed with the promised restriction of future airport charges to those current. With the intention of the Chancellor of the Exchequer to terminate offshore tax avoidance, the raising of perhaps £50 to £100 billion by issuing bonds onshore, disincentivised with payment of withholding tax, is an unlikely prospect. The maintenance of its borrowings while amassing £23 billion in P&L reserves (and retained earnings) has raised the airport charges price cap as finance costs are taken into account in the Regulatory Asset Base by CAA. If the borrowings were to be cleared by recourse to the reserves, the price cap could be lowered.

Clearance of existing local facilities

But it is far from clear which government agency (or agencies) will co-ordinate with the airport the destruction of whole communities and the relocation of houses, a school, hotels and many businesses, including the Waterside complex and the Energy-from-Waste plant. Is this a fair charge on the taxpayer and burden on the government's resources to support a company with ca. 90% foreign ownership engaged in tax avoidance?

The interference of Heathrow's business during the construction will hinder access to the airport, especially the tunneling of the M25 and the diversion of some of the peripheral roads. BA's administration will be hindered by the demolition of its headquarters. Just when Heathrow needs an increasing revenue to pay for the expansion it may well be reduced.

Heathrow's cost reduction

Heathrow has ditched the findings of the Airport Commission in seeking a cheaper solution for its expansion by shortening the length of the third runway, which it estimates can save £2.5 billion of the estimated £17.6 billion cost. However, the Airports Commission has added to the expansion cost "core capital expenditure" of £13.4 billion, "asset replacement" of £16.5 billion and "surface access costs" of £5 billion, totalling £52.5 billion. (Airports Commission Table 11.2) The savings are thus insignificant.

Heathrow clearly cannot quintuple its borrowings without increasing its airport charges! It has asked HM Treasury to cancel domestic flight taxes (APDs) to alleviate its funding problem. Aviation provides just the main portion of its revenue, with some arising from retail leases, connection charges and parking, which could also be affected by the interference in its access.

CAA Regulation

The regulated "price cap" for airport charges is calculated in a Regulatory Asset Base from seven "building blocks" which includes capital expenditure and the interest thereon. Over the decade this has raised the airport charges and if the promise to the airlines that charges will not be raised is honoured, the current regulation methodology is inapplicable.

sSee https://www.after-oil.co.uk/HeathrowConsolidatedAccounts.htm for CAP1823 consultation October, 2019

FGP Topco Limited 2018

FGP Topco Limited has issued its 2018 annual report, as have its main subsidiaries.

Because of a £15m gain in the financial instruments FGP Topco has made a profit and in 2018 paid £70m in corporation tax. However, this is offset by the lack of £106m withholding tax from the interest payments of £533m.

Commentary

Subsidiary structure

Heathrow's complex array of its owner and main subsidiaries makes it very difficult to follow the money trail. Heathrow Holdco holds another 37 minor subsidiaries, none of which have yet been scrutinised. Because of repetition and duplication it is virtually impossible to decide with certainty which bit of money goes where. Some of the complexity can be attributed to the legacy components of the former BAA, but reform of the subsidiary structure is needed to afford clarity. Over the 12 years of this study, with 13 annual reports a year, to analyse the 156 annual reports, 13 annual returns, 3 prospectuses, rating agency reports, investor centre presentations, three committee hearings and media articles requires a team.

Of particular significance is that there are four finance companies, dealing with senior and junior debt, one of which Heathrow Funding Limited is registered in Jersey, has no employees yet issues 80% of Heathrow's debt.

Shareholdings

FGP Topco acquired Heathrow for £10.277 billion with an investment of just £2.855 billion 27.78% of its shares, the remainder of which was acquired with £7.392 billion internalised borrowings, adding £10,654 million to its gross debt, leaving FGP Topco with £13.515 billion debt by 31 December 2006. This would enable FGP Topco to recover its initial investment, in effect acquiring BAA for free.

From FGP Topco's 2015 annual return it has paid-up shares of just £13.1 million. Each subsidiary in the chain owns that following with various amounts of paid up shares, with values from £4 to £3.812 billion. ADI Finance 2 Limited, third in the subsidiary chain holds £2.666 billion shares in the fourth in the chain, Heathrow Airport Holdings Limited. The shareholdings in the chain of main subsidiaries may well be "legacies" of BAA, be expended and have little significance.

The Transport Committee in its report of 24 March 2018 (page 76) erroneously assumed that Heathrow Airport Holdings Limited is the owner of Heathrow and that it had equity of £2.7 billion. On Page 77 it referred to the Airport Commission's opinion that Heathrow Airport Limited could raise equity and debt, presumably without realising that the owner is FGP Topco Limited and bonds are issued by one or more of the four financing subsidiaries. There is no reference to the actual owner FGP Topco Limited in the reports of the Airport Commission, nor in the Transport Committee's report.

FGP Topco's dividends, tax credits and non-payment of withholding tax

Dividends, taxation and interest payments on bonds and financial instruments feature in most of the main subsidiaries' accounts and may not be fully consolidated in the accounts of FGP Topco Limited. If consolidated, then over the ten years of its life, dividends amounting to ca £4 billion have been paid to shareholdings of only £13.1 million. Tax credits of £693 million have been gained instead of paying corporation tax and its bondholders may have avoided withholding tax of ca. £1billion.

The "dividend" trail

Presumably the only true dividend is that paid to FGP Topco and appears in its consolidated accounts. The dividends in the "trail" are actually surpluses passed up the chain, sometimes "dividends" and sometimes "incomes". In some cases "dividends" augment a subsidiary and in some reduce reserves. The pluses and minuses are not properly recorded and the "trail" could disguise un-accounted transfers.

Heathrow Funding Limited

It is not clear how HFL's "securitisation" status has benefitted its ultimate parent FGP Topco's tax position. The "profit" shown in its accounts is just the difference between the sum it receives from the main subsidiaries and that paid on interest to its bondholders and the loss or gains from its "financial instruments". The relevance of this miniscule tax payment is unclear. (Just £8,600 in 2014) .

Profit and Loss reserves

Apart from LHR Airports the main subsidiaries in 2018 held profit and loss reserves, the aggregate of which is £22.883 billion. If this is a real figure it means that the borrowing of a somewhat lower but commensurate sum means that its debt is artificially lifted in order that the interest payments can exceed the operating profits, reducing corporation tax and gaining tax credits. In some countries, the amount of interest set against profit is limited to say 40% of the operating profit, leaving 60% to be taxed. As infrastructure Heathrow has a Public Infrastructure Exemption (PIE) and can set all of its financial costs against profits.

Heathrow's borrowings

On maturing, to meet the Chancellor of the Exchequer's stop on tax avoidance, offshore issued bonds could be progressively replaced by onshore equivalents with reformed prospectuses with mandatory payment of withholding tax..

The Autumn Statement 2016

If there is evidence that the Chancellor of the Exchequer is succeeding in his mission of stopping tax avoidance, it would be interesting to know of successes. Heathrow's base prospectus issued in 2017 has ignored his pledge.

Funding Heathrow's expansion

Even if the expansion is restricted to improving the handling of larger numbers of passengers and bigger amounts of freight per air transport movement, the current funding with low equity and huge borrowings is inappropriate. In any case the runway is not needed as the deployment of bigger aircraft is providing the expansion in passenger and freight traffic. I

Heathrow's cost reduction

Heathrow's search for a lower cost expansion, together with the refusal of the airlines to pay additional airport charges, means that the findings of the Airports Commission can be discarded.

If Heathrow and the Secretary for Transport do defy the logic of deploying bigger aircraft and if the building of the third runway goes ahead, the reduction in its revenue by the interference of its access, its current mode of debt financing will not suffice for the expansion and could lead to its bankruptcy.

Heathrow's business without a third runway

See https://www.after-oil.co.uk/runway.htm and https://www.after-oil.co.uk/LHR_Business.htm

Links

(1) Base Prospectus 2017 https://www.heathrow.com/file_source/Company/Static/PDF/Investorcentre/Heathrow_Funding_Limited_base_prospectus_June_2017.pdf

(2) Base Prospectus 2018

(3) S&P Global Ratings February 2018 https://www.heathrow.com/file_source/Company/Static/PDF/Investorcentre/Ratings-Direct-Summary-Heathrow-Funding-Ltd-Feb_2018.pdf

(4) S&P DirectRatings December 2018

(5) S&P Research February 2019 https://www.heathrow.com/file_source/Company/Static/PDF/Investorcentre/Brexit-Still-Weighs-On-Heathrow-Rating-Despite-Strong-Earnings-in-2018.pdf

John Busby - Revised 21 October 2019