In the 2022 Autumn Statement The Chancellor of the Exchequer stated that HPC and SZC would expect to remain generating for 50 years. In the case of SZC which, if started in construction in 2025, would from 50 years from 2035 require a supply of uranium fuel to 2085.

Uranium initial fuel charge

UK-EPR Fundamental Safety

Overview Volume 1: Head Document Chapter A: EPR Design DescriptionPage 30 Table 2-1: Preliminary Core Parameters

Number of fuel assemblies 241

Assembly UO2 mass (oxide) 598 kg

Total UO2 mass (oxide) = 241*598/1000 = 144 tonnes

With initial charge is 144 tonnes UO2, the U initial charge is 144 * 238/270 = 0.881*144 = 127 tonnes U

A third of the fuel charge is exchanged annualy, so the fuel change is 127/3 = 42.3 tonnes U/y

HPC initial charges = 2*127 = 254 tonnes U

Fuel changes

Subsequent fuel changes are at a third of the whole @ 42.3 tonnes

The natural uranium equivalent is 8 times U (7 times theoretical)

HPC Initial charges 254*8 = 2030t and fuel changes need 84.6*8 = 677t.

So over its prospective 50 year life HPC needs 2030 plus 50*677 = Say 36,000 tonnes of natural uranium.

With SZC this is 72,000 tonnes, from 2030-2085 over perhaps 50 years, or say 1,440 tonnes natural uranium per year.

.

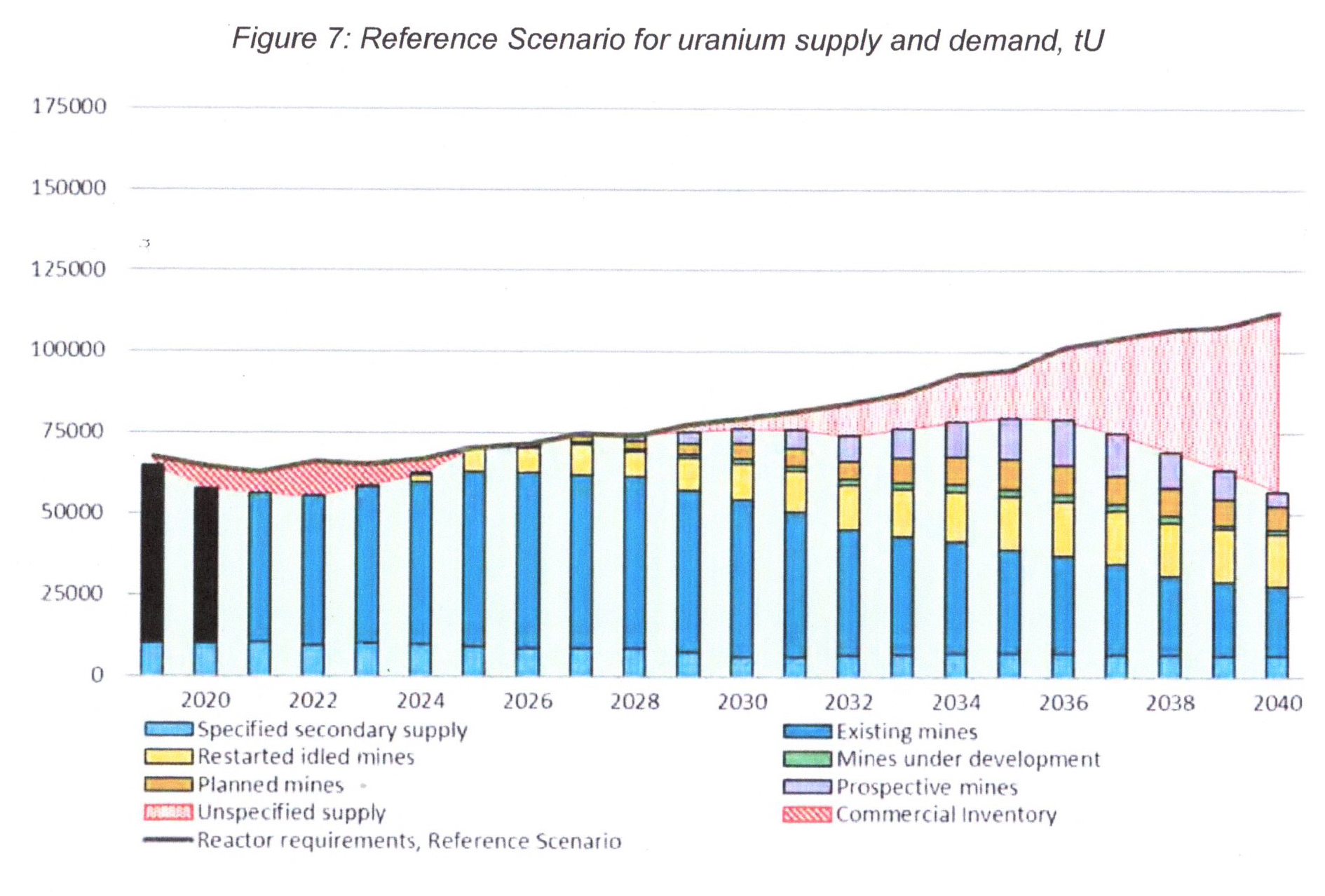

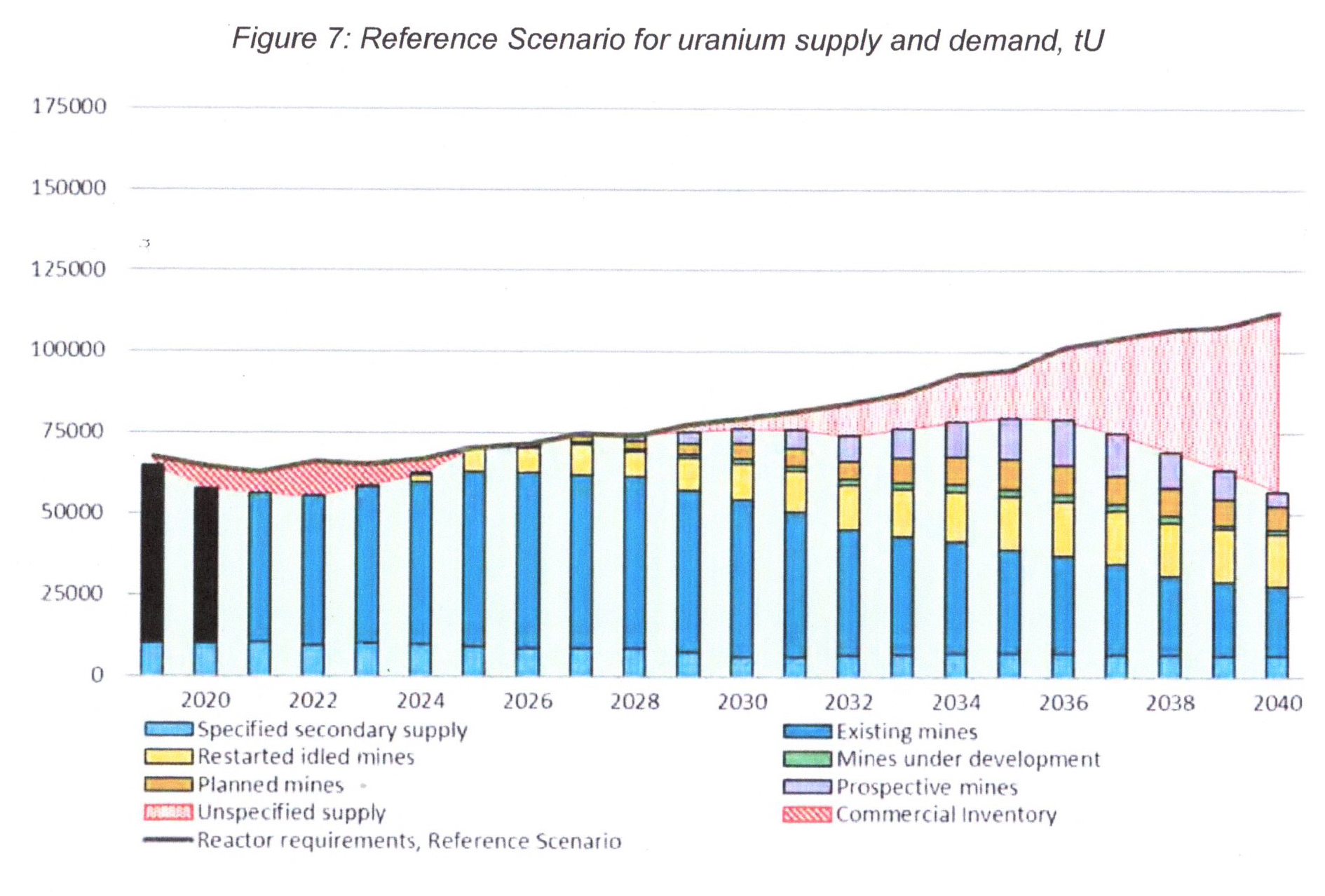

WNA has published the 2021 edition of The Nuclear Fuel Report

The report notes that world production dropped from 63,207 metric tons of uranium in 2016 to 47,731 tU in 2020, adding that unfavorable market conditions, compounded by the pandemic, led to a sharp decrease in investment in the development of new and existing mines.

The currently depressed uranium market, says the report, has caused not only a sharp decrease in uranium exploration activities (by 77 percent from $2.12 billion in 2014 to nearly $483 million in 2018), but also the curtailment of uranium production at existing mines, with more than 20,500 tons of annual production being idled. Uranium production volumes at existing mines are projected to remain fairly stable until the late 2020s, then decrease by more than half from 2030 to 2040.

Asserting that intense development of new projects will be needed in the current decade to avoid potential supply disruptions, the report calls for a doubling in the development pipeline for new projects by 2040.

See Figure 7 from the WNA Fuel Report 2021

The Figure 7 shows that by 2025 natural uranium stocks are exhausted, and that if the declining supply trend is extrapolated, by 2050 the world’s nuclear power sector will have run out of fuel unless the decline in natural mining supply is reversed.

John Busby Revised 29 December 2022