Ludwig Bölkow founded the company Ludwig Bölkow Systemtechnik GmbH in the early 80’s with the intention of developing new energy sources. The present company, engaged in broad energy studies, is led by Jörg Schindler. One of its partners,. Dr Werner Zittel, is a member of ASPO*. The company’s website “energiekrise.de”, or “energy crisis”, is a German language energy matters website which supplements two other similar websites, the US “oilcrisis.com” and the European “peakoil.com”.

The article below appeared on the “energiekrise.de” website in August 2006; but when our regular contributor John Busby realised its relevance to the scrutiny of “booked” oil equivalent reserves claimed by the oil majors (see his article ignotum per ignotius), he translated it into English for the Real Energy Review.

It shows that rather than devote a generous portion of their record profits to the exploration of new reserves, three oil majors have predominantly preferred to “buy-back” their own shares.

*Association for the Study of Peak Oil

From the Energy Crisis website (http://www.energiekrise.de) is extracted an analysis of the annual reports of the oil majors issued on 4 August 2006 by Jörg Schindler and Werner Zittel of Ludwig Bölkow Systemtechnik GmbH.

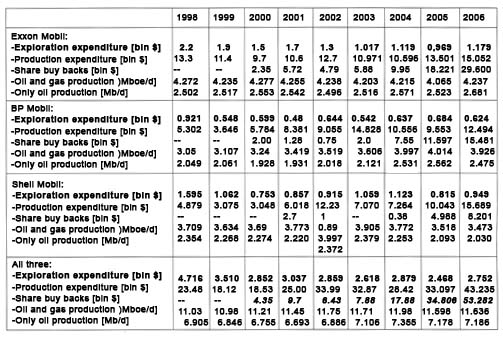

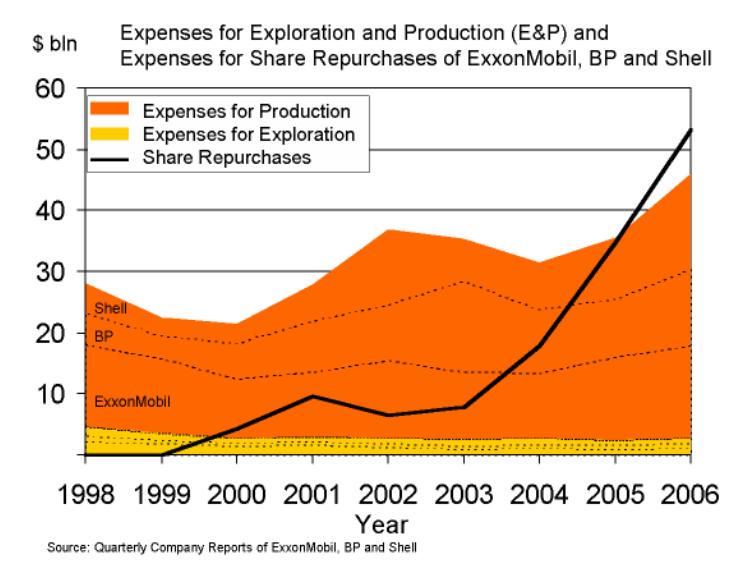

In their annual reports for the year 2006 the oil majors showed record profits. As in previous years, some of these were invested in exploration and in the maintenance of production. However, for the first time in 2005 the aggregated sums the three companies expended on the buying back of shares exceeded the total expenditure on exploration and production. See Table 1. From this, can it be concluded that the oil majors envisage no appropriate investment possibilities?

Table 1: Exploration and production expenditure of the largest Western oil companies, expenditure for share buy backs and annual oil and gas production according to annual reports.

Of interest is the the annual trend of the various items of expenditure. It is generally accepted that because of a low oil price for a long time there has been little exploration, but now that prices are high one wonders why this is not reflected in the figures presented - expenditure in exploration in 2006 was only 60% of that in 1998. Aggregating the figures for all three companies it can be clearly seen that the cost of production has risen (from $5.8/boe in 1998 to $10.2/boe in 2006).

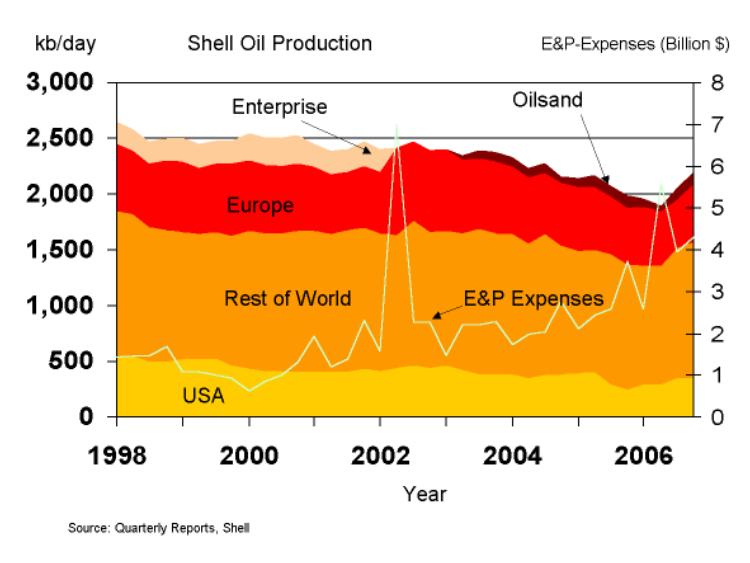

An analysis of the following three graphs shows escalating production costs in parallel with no significant increase in output.

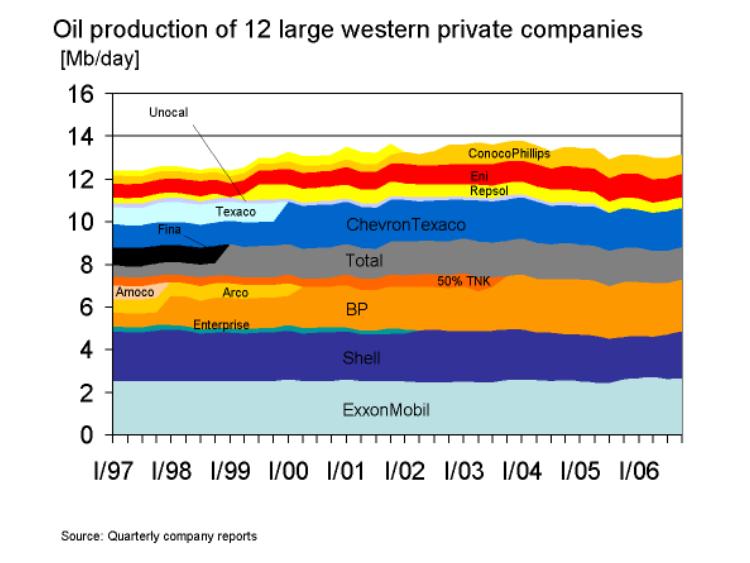

Linked with the record profits it can be seen that the oil majors have found it ever harder to increase production. In particular, Shell has in the last few years attempted by acquisitions (as in the case of BP with Amoco and Arco or Exxon with Mobil) to improve the level of production. Taking this into account it is not surprising that within the last eight years production has already dropped by 20%. Moreover the involvement in the Canadian oil sands cannot alleviate the situation as the related investment is expensive and the progress is slow.

However, over the entire sector an increase in production is proving ever more difficult to attain. The following graph shows the oil production of the largest Western oil companies:

There is currently a great debate as to whether a peak in oil production is imminent: as far as the Western oil majors is concerned it was passed in 2005.